The number 1 Expert Source of VA loan FAQS

If you’re thinking of getting a VA loan, you might have a lot of questions in mind. In this guide, we cover all the frequently asked questions you might have on VA loans. Take a closer look at our VA home loan FAQ below.

How Much Money Do I Need For A Down Payment On A VA Loan?

There is no down payment on a VA loan, which is one of the major selling points of the loan. It is backed by the US Department of Veterans Affairs, with no down payment required. Most mortgage programs require between 3.5 percent and 5 percent for the down payment.

How Do I Know If I Am Eligible For The VA Home Loan Program?

You are eligible for the VA home loan program if you meet the minimum active-duty service requirement. It is 24 continuous months or the full period, which is at least 90 days, that was required for your active duty. Also, you are eligible if you were discharged for a hardship or reduction in force but served for 90 days or more.

Does The Department of Veterans Affairs Lend The Money?

The Department of Veterans Affairs does not directly lend money, but there are VA-backed lenders who provide money to veterans, service members, and their survivors to build a home, renovate it and add energy-efficiency features. But eligible persons still need the required credit and income for the loan amount being borrowed.

Are VA Mortgage Loans Complicated?

VA mortgage loans are not complicated and close easier than other loans. If the borrower works with a VA loan specialist that can expedite the process, it becomes easier to apply and close the loan. Also, the eligible persons are easily identifiable, and it accepts those with lower credit scores.

What Are The Benefits Of A VA Home Loan?

There are different benefits of a VA home loan, which veterans and surviving spouses can enjoy. The most popular benefit is the lack of a down payment, which allows qualified borrowers to get a loan without worrying about money. The other benefits include:

- No private monthly mortgage insurance.

- Loose credit requirements.

- Lower closing costs.

- You can receive a loan after foreclosure and bankruptcy.

- Forgiving DTI ratio.

If I Am Eligible For A VA Mortgage, Why Do I Need To Get Prequalified?

You need to get prequalified even if you are eligible for a VA mortgage because it provides an estimate of how much monthly mortgage you can afford. Pre-qualification is recommended for all eligible borrowers before they start looking for a home. VA loan prequalifying involves an initial assessment of the borrower, checking if they qualify for the loan.

How Do I Obtain My Proof Of Military Service?

You can obtain your proof of military service by requesting your military records. You should fill out the DD214 form and ask for other military records. You can sign into milConnect and click on Documentation or Correspondence. Then, select the Personnel File tab and click on Request My Personnel File. Finally, fill out the form and click the Send Request button.

How Many Times Can I Use My VA Home Loan Benefit?

There is no limit to how many times you can use the VA loan benefit as long as you are still eligible and you qualify with a lender. It is also possible to take more than one VA loan at the same time if the circumstance allows it. But you should always check the lender requirements when taking multiple VA loans.

How Long Does It Take To Get A VA Mortgage?

It can take between 40 and 90 days to get a VA mortgage. It depends on the lender and whether you meet the requirements. While the pre-approval process can be completed in about 24 hours, it would take about a month to get approved and close the loan. It’s important to work with a reliable lender that can speed up the process.

Can You Use The VA Home Loan Benefit On A Property Outside The United States Of America?

You cannot use the VA home loan benefit to buy a home outside of the United States of America. VA loans can only be used to buy properties within the US territories. If you are stationed outside of the country, you can still receive a VA loan, but it must be for a property in the United States.

What Minimum Credit Score Is Needed For A VA Loan?

There is no minimum credit score needed for a VA loan. Borrowers can apply for the loan with a credit score as low as 640. With a poor credit score and existing debt, you can enjoy a low-interest rate on the VA loan, and there are monthly payments with no mortgage insurance.

What Fees Are Associated With VA Home Loans?

The fees associated with VA home loans include the funding fee and closing cost. The VA funding fee is a one-time payment that the borrower makes on the VA direct or VA-backed home loan. It reduces the cost of the loan since there are no down payments required. Other closing costs include interest rates and discount points.

Can I Refinance My Conventional Home Loan Into A VA Loan?

You can refinance your conventional home loan into a VA loan. It is common to convert your existing loan or mortgage to a VA loan if the interest rates and insurance are too high for you.

Do All Lenders Offer VA Home Loans?

Not all lenders offer VA loans. It’s important to check for a lender that offers the VA home loan to veterans, service members, and surviving spouses rather than using any lender. Also, look out for reputable and professional lenders that you can trust. You can work with the VA loan specialists at Security America Mortgage to receive VA loans.

Who Doesn't Pay The VA Loan Funding Fee?

Those that don’t pay the VA funding fee include:

- Persons receiving VA compensation for a service-connected disability.

- Persons who are eligible to receive VA compensation for a service-connected disability but are receiving active-duty or retirement pay instead.

Except you are exempt, you have to pay the VA loan funding fee.

What Type Of Service Is Eligible For A VA Home Loan?

Military service is eligible for a VA home loan. Those who currently service in the military or anyone who is a veteran are potentially eligible to receive a VA loan. Also, eligible surviving spouses, active service members, and National Guard members can receive this loan.

What Kind Of Property Can I Buy Using My Veteran Mortgage?

There are different kinds of property you can buy with a veteran mortgage, including two-, three-, or four-family properties, although you have to live in one of the units. Others include traditional detached houses, condos, new construction homes, and manufactured homes.

Can I Get Fixed Or Adjustable Rate VA Loans?

You can get fixed or adjustable-rate VA loans depending on your needs. The VA fixed-rate mortgage is one that provides a stable interest rate for the entire time, but it is not the same for the adjustable rate. But, since the adjustable rate changes, you can get a lower rate, and the rates don’t usually go up.

Where Can I Get My Certificate Of Eligibility (COE)?

You can get your Certificate of Eligibility through the Veterans Information Portal. Sign into the system and fill out the request form. You can also send a letter to the US Department of Veterans Affairs requesting your COE or work directly with your lender to get it.

Can I Qualify For A VA Home Loan If I Have Credit Issues?

You can qualify for a VA home loan even with credit issues. The VA home loan comes with loose credit requirements, so most eligible veterans, military people, service members, and surviving spouses will qualify for the loan. You can check if

Can I Use A VA Loan To Purchase A Rental Property Or A Business?

You cannot use a VA loan to purchase a rental property or business. Although the VA loan program provides relaxed qualifications for borrowing, the borrower must use the home or property being purchased as their primary residence instead of a rental property or investment property.

What Are The Other VA Home Loans Eligibility Guidelines?

The main VA loan-eligible guidelines include the following:

- You are on active duty, and you have served for 90 continuous days.

- You completed 90 days of active-duty service or six years in the National Guard or Selected Reserve.

- You are a veteran that met the requirements for 90 days in wartime and 181 days in peacetime.

- You are a surviving spouse of a veteran.

Other VA loan eligibility requirements include the property, down payment, debt-to-income ratio, and more.

Can I Get A VA Loan After Bankruptcy Or A Foreclosure?

It is possible to get a VA home loan after bankruptcy or foreclosure. VA loans are easier to obtain after bankruptcy than other loans, as long as you are an eligible active service duty member or a veteran. But you still need a good credit history and meet other financial requirements.

What Forms Do I Need In Order To Obtain A Veteran Home Loan?

The forms that you need to obtain a veteran home loan include a government-issued ID like a passport and driver’s license, two years of tax returns, self-employment income evidence or pay stubs, two years of W-2 statements, a Certificate of Eligibility, bank statements from savings, checking and retirement accounts.

What Is VA Loan Entitlement?

A VA loan entitlement is the amount that the Department of Veteran Affairs can guarantee to the borrower. It is the maximum amount that the VA will repay to the lender if the borrower defaults on the loan. This is similar to an agreement between the borrower and the VA if the former is unable to repay the loan.

Are Military Spouses Eligible For VA Loans?

A spouse of an active-duty member, former service member, or veteran can qualify for a VA loan as a co-signer or co-borrower through the VA loan. The spouse would have to get a Certificate of Eligibility to show that they are eligible for the loan.

What Should I Do If I'm Denied A VA Home Loan?

If you are denied a VA home loan, you can discuss it with a credit consultant to improve your chances and reapply after a while. Denial for a VA home loan is not permanent, as income levels and credit scores can change.

Can VA Loans Be Assumed?

VA loans can be assumed. Assuming a VA loan means that the borrower takes over an existing VA mortgage, even if the buyer is not a veteran, military service member, or eligible surviving spouse.

Can Children of Veterans Receive VA Home Loans?

Children of veterans and service members, even deceased, are not eligible for VA loans. Also, the pre-existing loans cannot be transferred to the children of veterans and service members. Only surviving spouses can receive the VA home loan.

How Can I Apply for a VA Loan?

You can apply for a VA loan by first obtaining the Certificate of Eligibility. After this, you have to prove your income and pass the CAIVRS check. Once you have completed this, you can apply with a trusted VA lender. The best part about having a reliable lender is that they can help you with the entire application process.

Is A Va Loan Better Than Other Loans?

A VA loan is better than other loans because it does not have a down payment, comes with competitive interest rates, and there is no requirement for mortgage insurance. The VA funding fee can also be rolled to the loan abalone and not paid up front. But, you have to be a veteran, service member, or military personnel to qualify for the loan.

What Type Of House Can I Build with a VA Construction Loan?

The type of house that you can build with a VA construction loan depends on the lender that you are working with. For instance, most lenders won’t accept a manufactured or mobile home, but will accept family houses. Speak to your lender to know more about the type of house you can build with the loan.

When Do Mortgage Payments Start with a VA Construction Loan?

Once your home construction is complete, you can start paying the VA construction loan back. The loan has to be repaid within the agreed-upon terms, and the repayment terms depends on the lender.

Are There High Interest Rates on VA Construction Loans?

There are no high interest rates on VA construction loans. The interest rate is not set by the Department of Veteran Affairs but depends on the lender. The lender would set the rate based on your credit score, debt-to-income ratio and lending history.

Can I Purchase a House and Fix It Up With a VA Loan?

Yes, a VA loan allows you to purchase a house and fix it up. If you are eligible for a VA loan, you can purchase a house and repair it with the VA renovation loan. This allows you to roll the repair costs to your mortgage. You can check the repairs that are allowed under the VA loan.

Can I Renovate My Bathroom With a VA Loan?

Yes, bathroom renovations are allowed under a VA loan. With a VA renovation loan, you can renovate the essential lavatory and sanitary facilities. The loan provides medically necessary improvements and structural alterations to your primary residence. But, the loan will not pay for a spa, jacuzzi or hot tub in your bathroom.

What is The Difference Between The VA Renovation Loan and VA Loan?

The VA renovation loan and the VA loan don’t have a lot of differences, but the former is more difficult to get than the latter. The VA renovation loan comes with all the benefits of a standard VA loan, like allowing borrowers to purchase a home without a down payment. But, if you are getting funds for repairs, you need to get quotes from registered contractors and more to get approval.

What Are the VA Home Improvement Loans?

The VA home improvement loans include the VA renovation loan, VA cash-out refinance loan, and VA energy efficient mortgage. The VA rehab loan allows you to add repairs and upgrades to your personal residence. Then, the cash-out refinance loan allows you to tap into the equity of your home to fund an improvement project. The VA energy efficient mortgage allows you to add energy-friendly features to your home.

Who is Eligible for a VA Rehab Loan?

Anyone that is eligible for a VA loan can also get a VA renovation loan. You should meet the minimum service requirements, lender credit standards and property requirements to get a VA renovation loan. There is also a maximum renovation cost that is included in the VA rehab loan.

What Home Improvements Can I Make With A VA Loan?

You can only make repairs or upgrades that improve the safety or livability of your primary residence, and not luxury features. A VA renovation loan allows you to repair or replace the heating and cooling system, replace old appliances, fix walkways, add features for those with disabilities and more. But, you cannot use it for major structural changes like tearing parts of your home down or adding a pool.

Are VA Loans Approved Automatically?

VA loans are not approved automatically, as the lender would first check all the necessary documents. The borrower must also comply with all the VA requests to receive the loan. You can work with your lender to get your VA loan approved as quickly as possible.

Can VA Loans Get Denied?

VA loans can get denied although this is rare. Lenders don’t always deny VA loan applications, but it happens occasionally. The main reason why this occurs is due to application errors or if you are not eligible for the loan. If your loan is denied, you can reapply after improving your odds or work with a reliable lender.

What Should I Do If I Can’t Get a VA Construction Loan?

If you are unable to get a VA construction loan, you can consider getting a construction loan from a local lender or a builder, and then refinancing it into a permanent VA loan. Many lenders don’t provide a construction loan to build a new house.

Can I Buy A Farm With a VA Construction Loan?

You can only buy a farm with your VA construction loan if it is your primary residence. If the farm is simply a land, you cannot use the loan as it would not be approved. But, if your residence is on the land, the loan would most likely be approved.

Is There an Owner-Occupancy Requirement on a VA Construction Loan?

There are owner-occupancy requirements set by the VA. For instance, the VA states that the property cannot be used as a second home, investment property or vacation home. Also, you must move into the home within 60 days after closing, although this can depend on your military assignment.

When Can I Restore My VA Loan Entitlement?

Your VA loan entitlement can be restored after a foreclosure, as long as you could pay the loan back. In full, and during the required time. But, it would be complicated to get another VA loan after a foreclosure. It would take about two years to be considered by a VA approved lender.

Can You Build a Patio with a VA Renovation Loan?

You cannot build a patio with a VA renovation loan. Cosmetic improvements like adding an outdoor patio are not allowed. Other examples include a swimming pool. Also, if you apply for a major repair and don’t complete it within 120 days, the loan application would get disqualified.

What's the purpose of the VA funding fee?

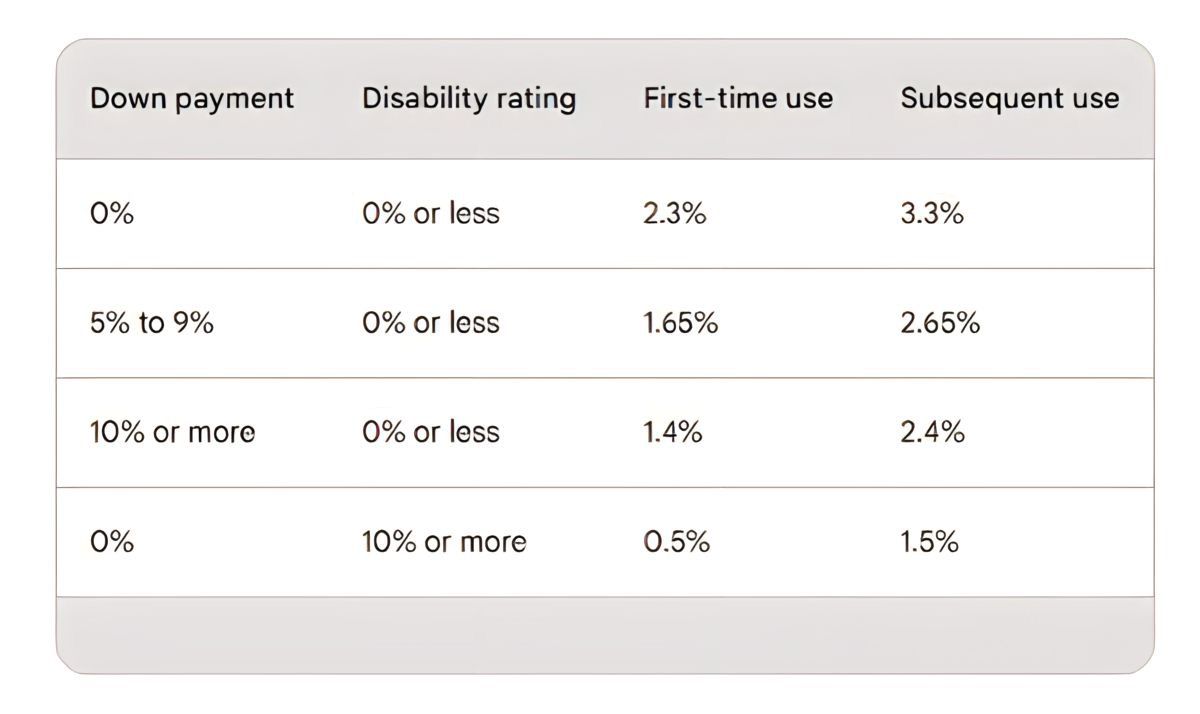

A VA funding fee is a one-time fee that is paid to the Department of Veterans Affairs by borrowers who use a VA loan to buy, build, renovate, or refinance a home. The purpose of the VA funding fee is to help reduce admin costs associated with the VA loan program which keeps the program sustainable. The amount of the VA funding fee is based on:

- Whether the borrower is a first-time or repeat VA home loan user

- Whether the borrower makes a down payment of at least 5%

- The borrower’s military service

- The borrower’s disability rating is a factor in determining if there will be a VA funding fee. Borrowers who are 10%-100% disabled as a result of their military service and borrowers who are receiving VA compensation for a service-connected disability are exempt.

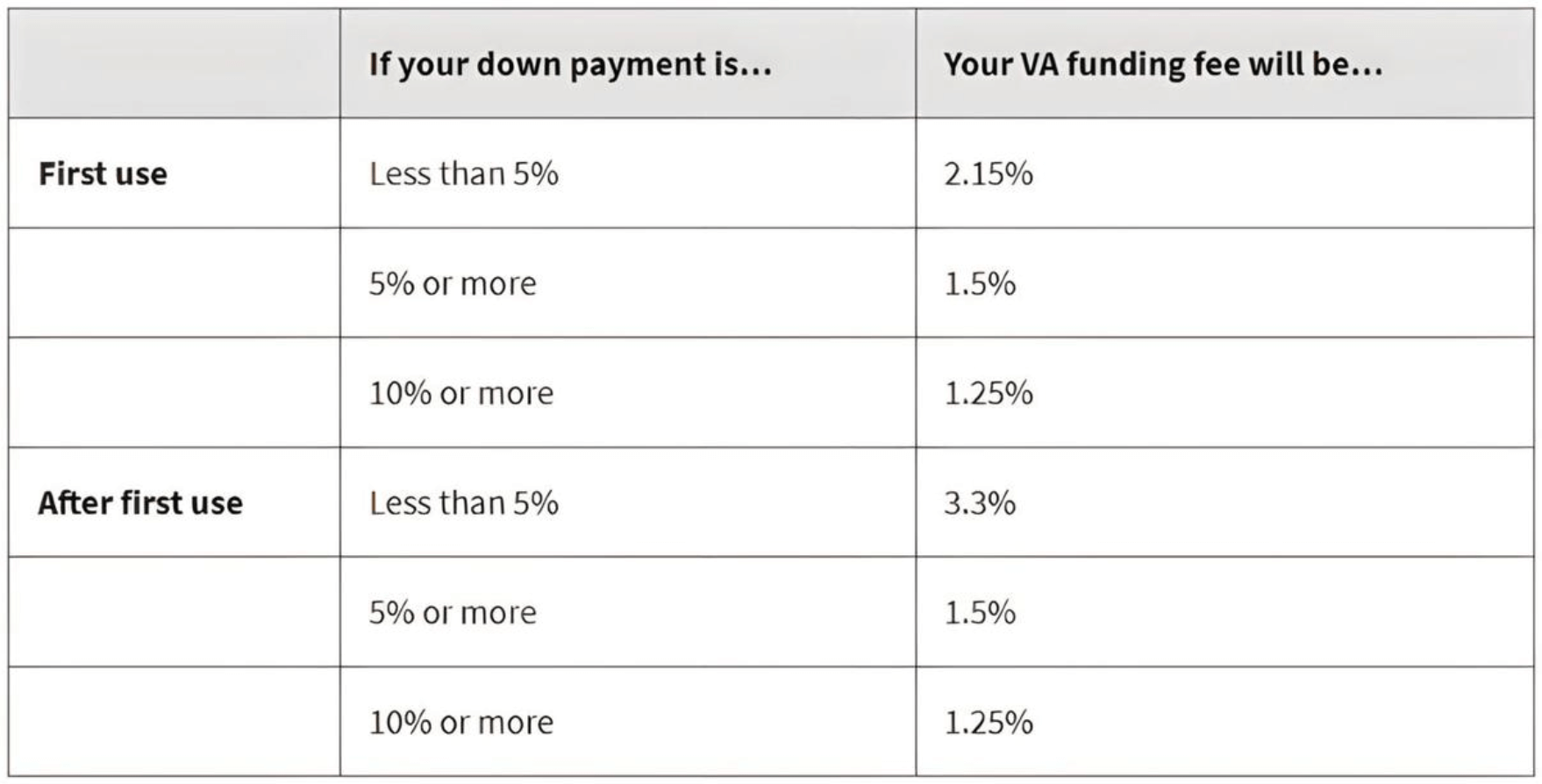

The current funding fees for VA home loans are as follows:

- First-time use with a down payment of less than 5%: 2.15%

- First-time use with a down payment of at least 5%: 1.5%

- Repeat use with a down payment of less than 5%: 3.3%

- Repeat use with a down payment of at least 5%: 1.5%

- Repeat use or first-time use with a down payment of 10% or more is 1.25%

How are VA loans different from other types of mortgages?

VA loans don’t require mortgage insurance and often require no down payment. Further, they tend to be less stringent with credit history than that of Conventional and FHA loans. If you compared a 30-year VA loan with no down payment to a 30-year conventional loan with 5% down with all qualifying factors the same; you’d likely see a better interest rate for the VA loan borrower. VA loans also have protections such as non-allowable fees. The VA guarantees a portion of the va loan so that the lender is protected if the veteran defaults on the va loan. This makes it easier for veterans to get a VA loan.

Why might a VA borrower want to make a down payment even if it’s not required?

VA borrowers might want to make a down payment if it can lower their interest rate, reduce their funding fee, help them qualify, or reduce their payment.

Do you think va loans are harder for Veterans to qualify for than other home loans like conventional loans and FHA loans or easier?

What makes VA home loans easier is the flexibility with qualifications. Credit scores, debt-to-income ratios, and assets. In addition, the Veteran can typically decide to have no down payment, and with flexibility for VA loans, you can negotiate for the seller to pay all of your closing costs. This means a Veteran has the potential to buy a home with zero out-of-pocket.

How does VA loan entitlement work?

Entitlement first starts with service and having been honorably discharged and meeting the minimum service requirements. Basic entitlement starts at 36K Secondary entitlement is determined by the county loan limit that you want to obtain a VA loan. There isn’t a limit on how much you can borrow to get 100% financing when you have full entitlement and have never used your VA loan benefit. Entitlement changes are based on whether you’ve used your VA loan before, subsequent usage, and bonus entitlement. VA loan entitlement represents how much of your VA loan the Department of Veterans Affairs will guarantee. Usually, you’ll have full entitlement if you’ve never used your VA loan benefit before. VA loan limits only apply to subsequent users of the VA loan benefit.

VA Loan Faqs

Yes you can buy the land and get a construction loan at the same time with a one time close.

As little as 30 days. Average 60 days. Could take up to a year in some cases.

VA Loans have many benefits not offered by conventional loans, especially for first-time homebuyers with little or no money for a down payment. Unlike conventional loans, VA Home Loans do not have private mortgage insurance requirements. Additionally, VA Loans usually have lower rates than conventional loans and are not subject to the closing costs associated with conventional rehab loans. This is because there are certain fees that borrowers cannot be charged. VA Home Loans also gives you the ability to refinance to a lower rate without having to re-qualify for the loan, a process known as a VA Streamline Refinance, or IRRRL. Getting started on your VA Loan is easy; simply contact a VA Loan Specialist at 1-855-824-6727.

This means the VA guarantees the loan to the lender in case you default on the loan. It does not mean that you are guaranteed a loan; you still have to qualify for it based on credit and income.

Yes, most of the time lenders only look at the last 12 months of credit history: however, bankruptcies, tax liens, and collections could have an adverse effect even if they are over 12 months old.

No, the VA does not offer any interest-only programs at this time. On all VA Loans, you pay back to the principal of the loan and gain equity with every payment.

No, the VA does not offer stated or no-document programs. All loans through the VA require full documentation.

No, the VA guarantees the lender on the loan. There is no third-party mortgage insurance required with a VA loan.

No, with a VA purchase you cannot get cash back at closing other than your earnest money or other money you put down beforehand. If energy-efficient improvements are being made to the home, the VA does allow the loan amount to go above the purchase price of the home.

Your entitlement is the amount that the VA will guarantee for your loan with the lender. $36,000 is the maximum entitlement and will allow you to purchase 100% up to $729,000.

This is allowed, but the guidelines are very strict. The second loan has to be equal to or better than what you would get with one large VA Loan. The rates on second loans are nearly always higher and, therefore, would not fit guidelines. Also, many lenders will not allow a second loan behind the VA Loan during a purchase.

No, at this time the VA does not guarantee HELOCs. The VA will allow you to cash out on your existing property up to 90%.

Equity is the amount of value a homeowner has in their property. You can calculate your equity by subtracting any liens or debts against your home from what your home is worth

A discount point is a percentage of the loan amount you will pay to buy your interest rate lower. You can buy a lower rate with discount points, which can sometimes save you money over the life of the loan.

A statement of service is a letter from your commanding officer stating how long you have been in the service and what your status is. It is required documentation to receive your Certificate of Eligibility.

Title insurance is insurance you get in case a lien is found against the property after you buy it. The title company will do a thorough check to make sure that doesn’t happen. In the off chance a lien is found, you are covered.

A child care letter is a letter required on a VA Loan if the borrower has children under the age of 13. A VA Loan requires that childcare expenses are counted as liabilities for qualification purposes.

Most of the time, the realtor will want your pre-approval letter to show that you have been approved for a loan and for how much. This is a better bargaining chip with the seller because the seller will know you are approved for the loan and won’t have to wait while you find financing.

No, you can get pre-qualified before you even start looking for a property. This way you know what you can afford and what your payments will look like on the property that you end up choosing.

Many factors go into the timing of the process. To be safe, you should allow at least 30 days for the entire VA loan process to take place. However, it is possible to close in as little as two weeks. With the help of our VA Loan Specialists, the process is quick and easy!

Many local banks and credit unions are not approved to issue VA Loans. If your local bank is discouraging you from choosing a VA Loan, make sure it has the ability to issue VA Loans. For a majority of Veteran home buyers needing close to 100% of the purchase price, a VA Loan is often the best option.

If you have questions, or if you want to determine if a VA Home Loan is actually the best financial decision for you, you may get advice from a VA Loan Specialist at 1-855-824-6727

VA home loan rates may differ based on your credit score, loan type, loan duration, and the current state of the market. Treasury bond, Ginnie Mae bond and Fannie Mae bond rates and yields can affect market rates on VA home loans. There are other factors on market rates for VA home loans and Security America Mortgage uses tracking tools to help lock in the best market rates for our clients.

Loan credit requirements for VA home loans are set by the lender, meaning they can differ from mortgage company to mortgage company. Most lenders require a minimum credit score of 640; however, some lenders accept credit scores as low as 600.

If you’ve already used a VA home loan, paid it off in full, and wish to buy a second property without selling the original one, you can have your previously used VA loan entitlement restored – but only once. However, if you’ve paid off your previous VA loan in full and sold the property you used it to buy, you’re free to restore your entitlement as many times as you want.

Not necessarily – Florida VA loans are a specific niche in the market, and not every mortgage company provides them. Even if a general mortgage company does provide VA loans, you may be better off choosing a Florida VA loans specialist like Security America Mortgage – we have the specific expertise and experience to guide you through the process and make the most of your loan entitlement.

Generally, the law states that a VA home loan must be used for a home you intend to occupy within 60 days of closing. However, in some cases, this occupation requirement may be fulfilled by your spouse or dependent alone (as long as it is intended to be your own primary residence eventually as well). You cannot use a VA home loan to buy a property that is solely intended as an investment. However, they can be used to purchase properties with up to four units, meaning that as long as one of these units is your primary residence the other three may be used as income properties.

The builder should fill out Form 26-1852 with a description of all of the building materials, and submit it (along with a copy of the building plans) for approval.

This option requires a “project review”, Since the maximum number of draws will be based on the house type and the draw amount will be based on the inspections and percentage of completion.

The builder has 2 options for the OTC program. The builder will receive draws according to the budget establised by the builder and the AFR OTC team. An inspection will take place to ensure the work is complete prior to any disbursement. Or, your builder can agree to no intermim construction draws through out the process and will recieve all their moneies at the time time the home is complete. This can save time since there are no 3rd parties and the admin fee is lower for the builder. In any case, the builder is responsible for completing the project review packet and should upload it into the resource center. A description of materials, builders certification, constuction/permanent loan disclosure, OTC closing disbursement authorization and OTC Construction cost breakdown or OTC no draw closing disbursment authorization. Shortly after closing, the process will begin and the administrator will contact the builder with a welcome letter and draw process. Up to 5 draws can be allowed in the draw program. Draws are on demand and up to builder’s discretion. Your interim draws are use to pay for site improvements. The line item percentage of completion method is used to determine draw amounts for site improvements. builders will recieve a draw based upon work completed or percentage therof. However, funds will not be advanced for work not in place. A project inspection is required for draws for site improvements and that fee comes out of the AFR administration fee. AFR will fund up to 80% of the builder’s contract price prior to the final draw provided that the work is in place. The builder must advise the Administrator when the project is completed so that a final inspection can be requested.

VA Loan rules state that the source of the construction work must be a VA-approved builder registered in the VA system.

Yes, land equity can be used as the borrower´s down payment.

For those meeting eligibility requirements it is possible to get 100% financing, as long as the required amount is within the standar VA Loan Limit, which is $548,250 for most counties in the country.

Yes. Actually, buying land with a VA Loan must be done simultaneously with constructing a new home.

Yes, VA Loan rules state that the constructor has to be a VA-approved builder registered in the VA system.

Building your home with a VA construction loan is a short-term process that takes approximately 5 to 12 months to finish construction and get a certification of occupancy.

It is posible. It depends on if you’re a Veteran with a certificate of eligibility and if you can qualify. Your debt to income, Loan to Value, credit and other factors such as job stability can affect your qualification. If you do our online loan application, we can see if you qualify. We offer a one time close (OTC) Construction to permanent loan.

Borrowers are can pay for upgrades out of pocket. Change orders must be approved, in advance, by the appraiser.

Commonly, it’s more difficult to get a construction loan than an existing home loan, as lenders are more cautious funding a home that doesn’t exist yet. One of the main differences in building your own costume home instead of purchasing, is the process: a VA construction loan is usually short-term– around 12 months to get you through the building stage. The builder will draw money from the lender in increments, and you will make monthly loan payments, keeping in mind they’re only interest payments. When your house is finished, you stop paying the construction loan and roll over to monthly mortgage payments, which is whatever’s left on the construction loan balance. VA Construction loans are for firstime homebuyers looking for an affordable option from the lack of offers on the market. But to make sure which product is the right one for you and to learn how Security America Mortgage can make this process easy for you, contact your VA Loan expert to discuss their differences.

Some advantages on buying a home are that the prices are usually more afordable, that the process is shorter when comparing to building a house, that there is room for negotiation, etc. But builing your own, also comes with its side of perks, for starters you will have it made to your especifications and particular needs, also there won´t be any buyers competition and it will have less maintenance issues. There are both pros and cons to each, but the decision at the end will come down to what is best for your unique situation.

As soon as possible: the VA requires that the borrower move into the home within 60 days after the VA loan closes

The loan broker must order the appraisal. However, the buyer is responsible to pay for VA appraisals and an approved VA appraiser must conduct an appraisal according to VA standards.

The appraisal will list an estimated value and how this estimate was derived. the appraiser will add the cost of the land to the cost to built the house.

Don’t worry! The lender, you and the builder are protected with insurance.

Construction loan interest rates tend to be a bit higher than traditional loan rates, as these loans are more complex and risky for lenders.

Interest payments, funding fee, inspection fees, commitment fees, title update fees, hazard insurance during the construction. (OR) A single construction fee which includes the construction interest, as well as: construction draw inspections, construction closing coordination, construction underwriting and title updates.

VA does not set a limit on the number of acres which a property may have.

If a house is dilapidated the builder can add the cost of demolition to the contract price, something we have done many times.

The VA loan limit in 2021 is $647,200 in most counties in the Country., and up to $970,800 in higher-cost areas. You can find your county limits here: https://securityamericamortgage.com/va-loan/jumbo-va-loan/

Today, the VA doesn’t have jumbo loan limits. You can borrow as much as you can as long as you meet the requirements and qualification of the VA and the lender. However, for a VA construction loan with AFR, there is a 10% down payment requirement for a loan amount above the applicable county loan limit. Also, if the veteran has another home under a VA mortgage, their entitlement will come into play and a down

The one time close provides interim construction financing, lot purchase if needed and a permanent loan wrapped into on. When you convert from the construction phase of the loan to permanent you don’t have to requalify. This saves money on closing costs such as a second appraisal.

Builders Risk Policy is a unique type of property insurance which indemnifies against damage to buildings while they are under construction. Builder’s risk insurance is “coverage that protects a person’s or organization’s insurable interest in materials, fixtures and/or equipment being used in the construction or renovation of a building or structure should those items sustain physical loss or damage from a covered cause.

Manufactured, modular, and stick built properties are options. There are many different types of materials such as drywall, plywood, 2 x4s, epoxies, roofing materials, nails, concrete, tile, flooring, fixtures, etc. Your plans will be approved by underwriting and the builder we be approved by SAM, AFR and the VA. You cannot build a kit home, log home, bamboo home, metal home, tiny home, storage container home or bardominium (Non traditional construction types aren’t eligible)

Yes, Single-Wide Manufactured Homes, Condominiums, Multi-Units, Duplex, Triplex, Quadplex, and unique/niche construction types such as Barndominimums, Kit Homes, Log Homes, Bambo Homes, etc.

2 Units, 3 Units, 4 Units, Co-Ops, Manufactured Housing Units built prior to June 15, 1976, Manufactured Housing in a Condominium Project, Manufactured, Housing that has been traded, Mixed- Use properties, properties Under Construction. Properties with commercial influence are subject to additional review. Any property where marijuana is grown or processed inside the home or on the property, regardless of the quantity or state law is unacceptable. SAM/AFR will not permit properties with more than 100 acres but perhaps you can subdivide.

You lock your rate prior to closing and construction and for the life of the loan.

No, there are no payments for the borrower during construction and no construction payments for the builder to make during construction.

Builders do not need to be approved by VA. They only need to register with VA to obtain a VA Builder ID number (In most cases, an ID number can be issued within a day or two).

We have a list of approved builders that you can look at here: Builders Map. Also, there is a list of VA approved builders here va.gov . However, just because they are approved there, it doesn’t mean they are approved with us so let us help you get them approved with us. Contact us!

No, you should not start any work prior to closing.

It depends. If the person has significant equity and has a good income then there’s a chance.

You’ll need to wait until a judge discharges your bankruptcy before you can get a loan, but exactly how long do you need to wait? The answer depends on the type of bankruptcy you have on your record and the type of loan you want. The most common type of bankruptcy is Chapter 7 bankruptcy. During a Chapter 7 bankruptcy, a court wipes away your qualifying debts. Unfortunately, your credit will also take a major hit. If you’ve gone through a Chapter 7 bankruptcy, you need to wait at least 4 years after a court discharges or dismisses your bankruptcy to qualify for a conventional loan. Government-backed mortgage loans are a bit more lenient. You need to wait 3 years after your bankruptcy’s dismissal or discharge to get a United States Department of Agriculture (USDA) loan. To qualify for a Federal Housing Administration (FHA) or U.S. Department of Veterans Affairs (VA) loan, you only need to wait 2 years after your discharge or dismissal. Chapter 13 bankruptcies involve a reorganization of your debts. Chapter 13 bankruptcy means you may need to make scheduled payments to your creditors. It doesn’t have as large of an effect on your credit score – and you can keep your assets. A Chapter 13 bankruptcy is less serious than a Chapter 7, but most types of loans still include a waiting period. The amount of time you need to wait to apply for a conventional loan after a Chapter 13 bankruptcy depends on how a court chooses to handle your bankruptcy. If the court dismisses your bankruptcy, you must wait at least 4 years from your dismissal date before you can apply. If a court discharges your bankruptcy, the waiting period is 4 years from the date you filed and 2 years from your dismissal date. Like a Chapter 7 bankruptcy, standards are a bit more relaxed for government-backed loans. USDA loans require a 1-year waiting period after a Chapter 13 bankruptcy. The waiting period is the same whether you get a discharge or dismissal. FHA and VA loans simply require a court to dismiss or discharge your loan before you apply.

Yes. However, you cannot use a VA Construction Loan tu build one.

Yes, currently, the land loan limit is $150,000. We may be able to get a small exception above the $150K but it’s not a guarantee.

Aside from being approved like you would for a VA purchase loan, you need to have a builder contract with plans, builder must be approved by us and have a registered builder ID with the VA. Depending on your county, there may also be building permits and septic permits that need to be approved before closing. You must also have the land under contract or own the land that you would be building on.

2 years of rental income need to be shown in order for it to be used as qualification income

No, the house needs to be valued more than the land

Yes, as long as the build contract is market price, no exceptions

Yes, these types of units are now allowed as of 1/25/2021

Yes, any builder that participates in the program must have general liability insurance of $1MM per occurence, have a valid state license, 3 years of building experience as well as 3 customer references, 3 trade references, 3 credit referances. The builder must also have workers comp if applicable and pass a business background check

Yes, you can.

Military veterans are utilizing the one time close construction loan more often now because there is a limited supply and excess demand in many market areas.

Building a home you can choose many of the amenities that you desire with focus on making the Home taylored fit for you

You will close on your loan before your home is built. During construction you will not have any payments. Building costs are being incurred during construction so they are rolled into and labeled as the admin fee.

We have a 5% contingency fee to cover this. You will be refunded us money should there be no additional cost. It is for everyone’s protection.

As a veteran you have the ability to utilize subsequent use. We will calculate your remaining eligibility for you so that you know how much buying and borrowing power you have. Often we see the situation.

The veterans administration defines the VA funding fee as a one-time payment that the Veteran, service member, or survivor pays on a VA-backed or VA direct home loan. This fee helps to lower the cost of the loan for U.S. taxpayers since the VA home loan program doesn’t require down payments or monthly mortgage insurance.

If you’re using a VA home loan to buy, build, improve, or repair a home or to refinance a mortgage, you’ll need to pay the VA funding fee unless you meet certain requirements. You won’t have to pay a VA funding fee if any of the below descriptions is true. You’re:

- Receiving VA compensation for a service-connected disability, or

- Eligible to receive VA compensation for a service-connected disability, but you’re receiving retirement or active-duty pay instead, or

- The surviving spouse of a Veteran who died in service or from a service-connected disability, or who was totally disabled, and you’re receiving Dependency and Indemnity Compensation (DIC), or

- A service member with a proposed or memorandum rating, before the loan closing date, saying you’re eligible to get compensation because of a pre-discharge claim, or

- A service member on active duty who before or on the loan closing date provides evidence of having received the Purple Heart

You may be eligible for a refund of the VA funding fee if you’re later awarded VA compensation for a service-connected disability. The effective date of your VA compensation must be retroactive to before the date of your loan closing.

You’ll pay this fee when you close your VA-backed or VA direct home loan. You can pay the VA funding fee in either of these ways:

- Include the funding fee in your loan and pay it off over time (called financing), or

- Pay the full fee all at once at closing

This depends on the amount of your loan and other factors. For all loans, we’ll base your VA funding fee on:

- The type of loan you get, and

- The total amount of your loan. We’ll calculate your funding fee as a percentage of your total loan amount.

Depending on your loan type, we may also base your fee on:

- Whether it’s your first time, or a subsequent time, using a VA-backed or VA direct home loan, and

- Your down payment amount

Note: Your lender will also charge interest on the loan in addition to closing fees. Please be sure to talk to your lender about any loan costs that may be added to your loan amount.

We don’t determine most details of your home loan. Your home loan lender will determine these details of your loan:

- Interest rate

- Discount points (fees you may pay to your lender at closing to get a lower interest rate on your loan)

- Other closing costs

These rates may vary from lender to lender. You should know that adding the VA funding fee and other loan costs to your loan could lead to you owing more money than the fair market value of the home. This could reduce the benefit of refinancing since your payment wouldn’t be as low as you may want it to be. It could also make it harder for you to get enough money out of the future sale of the home to pay off your loan balance.

The seller must pay these closing costs (sometimes called “seller’s concessions”):

- Commission for real estate professionals

- Brokerage fee

- Buyer broker fee

- Termite report (unless you’re using a refinancing loan)

You (the buyer) or the seller can negotiate who will pay other closing costs such as the:

- VA funding fee

- Loan origination fee

- Loan discount points or funds for temporary “buydowns”

- Credit report and payment of any credit balances or judgments

- VA appraisal fee

- Hazard insurance and real estate taxes

- State and local taxes

- Title insurance

- Recording fee

Note: We require that a seller can’t pay more than 4% of the total home loan in seller’s concessions. But this rule only covers some closing costs, including the VA funding fee. The rule doesn’t cover loan discount points.

Texas is well-known for being a pro-military state and as a veteran, you can enjoy the multiple benefits it provides to its military service members including property tax exemptions, state retirement benefits, Veterans Land Board Loan Program, Texas National Guard Tuition Scholarship Program as well as Veterans’ employment preference. In addition, home prices throughout Texas are quite affordable, for example the median sale price for a home in Dallas was $302,000 in May 2021.

VA-Backed Loans require 0% down payment in most cases, whereas conventional loans generally require at least a 3% down payment and sometimes up to 20% required; FHA loans require a minimum of 3.5% down payment. Also, with a VA Housing Loan, veterans do not have to pay any monthly mortgage insurance, which cannot be said about conventional or FHA mortgages. Many veterans in Texas have already taken advantage of their VA benefits. With relaxed qualification standards and more flexibility, it is proven to be the right choice for many to purchase and refinance their homes. However, in most counties, the conforming loan limit with no money down is $548,250. When your home costs more than this, the solution is a VA Jumbo Loan. A VA Jumbo Loan is any VA-Backed Loan bigger than $548,250 and qualifying veterans can apply to purchase or refinance their home for up to a value of $1,000,000 through this type of loan, plus receiving all the benefits of the general Texas VA Loan.

- Office in Houston, Texas.

- VA, FHA, and All Home Loan Types.

- $0 Down Payment for VA Home Loans.

- No Need for Private Mortgage Insurance.

- Low Interest Rates.

- Lower Payments.

- Easier to Qualify.

- Relaxed Credit Standards.

Everyone who meets the following could be eligible for a VA-Backed Loan:

- You have served 90 consecutive days of active service during wartime.

- You have served 181 days of active service during peacetime.

- You have 6 years of service in the National Guard of Reserves.

- You are the spouse of a service member who has died in the line of duty or as a result of a service-related disability.

Not necessarily – Loans through the VA are a specific niche in the market, and not every mortgage company provides them. Even if a general mortgage company does provide them, you may be better off choosing a specialist like Security America Mortgage – we have the specific expertise and experience as VA lenders in Texas to guide you through the process and make the most of your loan entitlement.

If you’ve already used a VA Loan, paid it off in full, and wish to buy a second property without selling the original one, you can have your previously used entitlement restored – but only once. Although, if you’ve paid off your previous Loan in full and sold the property you used it to buy, you’re free to restore your entitlement as many times as you want.

Whether you’re a veteran or active military member looking to build a custom home, a VA Construction Loan could be the perfect solution for you! Because of your military background, you have access to VA home construction loans that offer nothing down and additional perks and benefits. Usually, it’s more difficult to get a construction loan than an existing home loan, as lenders are more cautious funding a home that doesn’t exist yet. However, here at Security America Mortgage we are VA Construction Loan lenders as well as experts, and we will be more than happy to help you get your own custom dream home whether you want to build it in Dallas, Austin or any other county in Texas.

VA land loans are not a loan on its own, although you can enroll the cost of land purchase into a VA Construction Loan, simultaneously to the costs of building your house.

Loan credit requirements for VA Home Loans are set by the lender, meaning they can differ from mortgage company to mortgage company. Most lenders require a minimum credit score of 640; nonetheless, some lenders accept credit scores as low as 600.

Whether you need a down payment for your loan depends on the specific loan program you decide to use. In a traditional construction loan, most buyers need a down payment around 20% to access the most favorable one-time close loan terms. Our one-time close programs offer down payments anywhere from 0% to 3.5%, to a maximum of 5%, a small fraction of what other lenders typically ask for.

Credit is just one factor used to decide how much you can finance with your one-time close construction loan. A credit score of 700 or above is considered low risk, while a score of 800 to 850 is exceptional – but even very affluent people do not always have a score this high. Our one-time close construction program requires a minimum credit score of 640. We will examine your entire financial outlook and work with you to find a loan solution that meets your needs. Current income and investments are weighted heavily.

On most of our construction products, your first payment does not take place until after construction is complete.

Closing costs may vary depending on your situation and your total loan amount.

Ideally, new home construction is completed within about 12 months. Every step is taken by our in-house construction management team to complete the process in a timely manner. However, ultimate performance is up to the builder and unforeseen circumstances can happen. The type of home, its size, and the builder’s schedule all influence project length.

No. Your builder must complete all the work.

No. Investment properties and “spec” homes are not eligible.

Yes. Your land purchase can be rolled into your one-time transaction – and covered in your single closing.

Yes. You must own the land for at least six months (in most cases) to use its appraised value.

Teardowns and rebuilds are available for some loan types, but not others. To get accurate information for your specific loan type, talk to your loan officer about your needs.

Yes, if you’ve owned the land for 12 months or more by the closing date

Yes, if you have owned the land for six months prior to closing.

Yes, the fair market value of the proposed to be constructed subject property will be utilized to establish the maximum loan amount. Land value is based on the value as reported in the appraisal report without a seasoning requirement.

If you have owned your land for less than 12 months and you want a VA construction loan, we will use the land cost for value.

6 months.

It includes construction interest, construction draw and inspections, construction closing coordination, construction underwriting and title updates.

No, only one qualification and closing.

No, you will only need one appraisal

Manufactured, modular and stick built properties

Before

A veteran can get 100% financing with no money down on the current value of the property and the cost of remodeling and repairs.

No

Yes The veterans administration requires that her property meet minimum property standards in order to qualify for VA financing

$100,000

Yes

You can finance mine are remodeling and non-structural repairs

Yes if renovations are greater than $50,000

No it is for primary residence only

10 year, 15 year, 20 year, 25 year and 30 year

Active duty member of do US military, veteran honorably discharged or surviving spouse can utilize this benefit.

Four month max prior to closing.

No, the general contractor must be registered with the VA I must carry sufficient insurance three current general insurance liability policy

620 minimum fico score. If the loan I’m out is exceeding the VA county loan limits than 640 is the minimum credit score needed

Military veterans or active military personnel can buy a fixer-upper and utilize 100% financing as a result of their service to the country.

The VA renovation loan, the VA construction loan are very beneficial when there is a limited amount of options in the area that you desire. For example you might be searching for a home in a particular school district and find that there is nothing available except a fixer-upper. Properties in perfect order priced correctly sell very quickly in a sellers market.

The plans agreed to with the general contractor including information on the general contractor and other documentation will we analyzed during underwriting

Yes there will be a certification by a VA inspector to ensure the hole meets the property standards and is ready for occupancy.

Yes and this can be a great alternative to a cash out refinance.

No

No

No

No

No

No this is charged to the builder

Yes with conditions.

The contractor must be a subcontractor of the general contractor or the general contractor must build the pool. States include Texas, Louisiana, Mississippi and Texas for SAM. The pool must be in ground. Utilities must be turned on for appraisal inspections

The highest loan amount for mortgages that can be acquired by Fannie Mae or Freddie Mac. Mortgages above this limit are known as jumbo loans. The CLLs are set by the Federal Housing Finance Agency (FHFA) on an annual basis and vary geographically, using guidelines specified in the Housing and Economic Recovery Act of 2008 (HERA) and as modified in subsequent legislation. More information is provided on the FHFA CLLs webpage at www.fhfa.gov/CLLs.

At the end of each November, FHFA updates the CLLs based on rules set forth in HERA. The CLLs take effect a month later on January 1st.

(current year Q3 FHFA HPI – prior year Q3 FHFA HPI) / (prior year Q3 FHFA HPI)which is converted to percentage terms. For example, the 2022 limits were computed as: Percentage Change = (2021Q3 HPI – 2020Q3 HPI) / 2020Q3 HPI = (328.13182917– 277.95477273) / 277.95477273 = 18.05223776 percent HERA requires that the baseline loan limit be adjusted each year to reflect changes in the national average home price. In October 2015, FHFA published a Final Notice in the Federal Register specifying that limits would be adjusted using the nominal, seasonally adjusted, expanded-data (EXP) version of the FHFA House Price Index® (FHFA HPI®). An important caveat is that the CLLs adjustment differs during or immediately following a housing market downturn. By statute, the baseline loan limit remains flat when the national average home price is not increasing. Further, after a period of declining home values, HERA requires that the prior declines be “made up” before the baseline limit can be increased. In such instances, any cumulative house price decline must be fully negated before a loan limit increase can take place. For this reason, the baseline loan limit did not change in 2007 and they remained at the same level until 2017.

At the end of each November, FHFA updates the CLLs based on rules set forth in HERA. The CLLs take effect a month later on January 1st.

No. By statute, because of HERA’s specific adjustment rules, conforming loan limits do not decrease. When home values have declined according to the formula, HERA does not provide for decreases in the baseline loan limit. Loan limits remain the same as the prior year until house price declines have been “made up” and the current index level exceeds the prior FHFA HPI level before the decline started. This happened when the baseline loan limit was $417,000 from 2006 until 2017 when it increased by the net positive increase of 1.7 percent since the prior peak. The calculated increase is based on the gain compared to that prior level (not the third quarter from the earlier year). Such a scenario took place from 2007Q3 until 2016Q3 and the 2017 limits became the first increase in several years. FHFA has implemented a “hold harmless” approach where county-level loan limits do not decrease. This applies to counties where the median home value decreased relative to the prior year’s value. FHFA takes the same approach if a county were to drop out of a high-cost area and would suffer from a lower median value as a stand-alone county.

The FHFA produces three main HPI flavors – a purchase-only index, an all-transactions index, and an expanded-data index. CLLs are adjusted using FHFA’s national, nominal, seasonally adjusted, expanded-data index. The expanded-data FHFA HPI is based on an underlying sample of transactions that reflects the universe of what could be conforming loans, however, not all the loans have been purchased or securitized by Fannie Mae or Freddie Mac (the “Enterprises”). Data are combined between purchase-money mortgages from the Enterprises, FHA loans, and public records of sales transactions (with prices below the annual loan limit ceiling). Prior to HERA, the Mortgage Interest Rate Survey had been used to adjust loan limits. After house prices fell in 2007, loan limits remained unchanged and FHFA began to consider alternative measures to the monthly survey. The expanded-data metric was created and input was gathered from the public. In 2015, FHFA addressed those comments and its plans to utilize the seasonally adjusted, expandeddata HPI for calculating changes to the CLLs. A “Notice of Establishment of Housing Price Index” is posted in the Federal Register at https://www.federalregister.gov/articles/2015/10/22/2015- 26778/notice-of-establishment-of-housing-price-index. A major consideration had been the existing and well-known purchase-only index already published by FHFA but that index only utilizes Enterprise data. The expanded-data HPI employs the same basic methodology as the Enterprise specific purchase-only HPI but also incorporates additional historical transactions data. Specifically, the expanded-data indexes include transaction prices for homes with FHA-endorsed loans and homes whose transactions have been recorded at various county recorder offices through the country. The addition of these two supplemental data sources to the Enterprise data provides for a better estimate of the overall change in the U.S. average home price than is available from the other indexes. General price changes and trends should be similar between all of the FHFA HPIs, however, the expanded-data HPI is best suited to capture movements for the segment of the housing market that has 3 a price range such that sales transactions could be financed with conforming loans because they fall below annual loan limits.

The baseline loan limit is the highest loan amount for an acquisition in a particular year. This limit restricts the size of loan originations (but not the price of homes) across the nation except in a small amount of high-cost or statutory areas. The value varies across two dimensions, counties and the number of property units. Local loan limits are defined on a county-by county basis with most counties (around 95 percent) assigned the baseline loan limit. The baseline limits, however, can increase for properties that have more than one (but less than five) units HERA also defines “high-cost” area loan limits that can be as much as 150 percent of the baseline value. Loan limits are allowed to exceed the baseline value in areas with more expensive housing markets. Specifically, they are set at 115 percent of the highest county median home price in the local area as long as that amount does not exceed the ceiling. Local areas follow the definitions of corebased statistical area (CBSA), which means they can be both metropolitan and micropolitan statistical areas. As an example, loan limits for 2022 Enterprise acquisitions were established in 2021Q3 with the baseline loan limit being $647,200 for a one-unit property. According to data released by the U.S. Department of Housing and Urban Development, as of 2021Q3 the median home value in El Dorado County, California was $587,000. Multiplying this area median value by 115% yields a loan limit of $675,050, which is above the baseline limit but below the high-cost ceiling of $970,800. As a result, the loan limit for El Dorado County was set equal to $675,050. Loan limits are also higher in certain statutorily-designated areas like Alaska, Hawaii, Guam, and the U.S. Virgin Islands. The limits in these statutorily-designated areas cannot exceed 150 percent of the high-cost ceiling value. Lookup tables are provided on the CLLs page at https:/www.fhfa.gov/CLLs.

HERA provisions set loan limits as a function of local-area median home values. The CLL is required to be increased in areas where 115 percent of the median home value exceeds the baseline CLL, not to exceed an amount that is 150 percent of the baseline CLL. To perform calculations, counties are grouped by core-based statistical areas (CBSAs) as delineated by the Office of Management and Budget. FHFA coordinates with the U.S. Department of Housing and Urban Development to calculate CBSA-wide median home values equal to the median price for the highest-cost component county in each CBSA. Each county in the CBSA receives the same value and a high-cost loan limit is assigned as described above if the multiple exceeds the baseline CLL. For example, Sacramento-Roseville-Folsom, CA is delineated by four counties. As of 2021Q3, the highest county median home value was $587,000 which when multiplied by 115 percent gave a loan 4 limit of $675,050 that was above the baseline loan limit. This value was applied similarly to all counties in that CBSA. Some areas are extremely expensive, but their loan limits are still capped. In 2021Q3, the nation’s capital (Washington-Arlington-Alexandria, DC-VA-MD-WV) had a median home value of $975,000 which exceed the high-cost area ceiling of $970,800. In these instances, all counties within the CBSA receive the high-cost ceiling as their loan limit value. Finally, not all CBSAs qualify as being high-cost areas. The capital of Florida, Tallahassee, is a CBSA with four counties but their highest county median home value was only $214,000 which means the local area is not expensive enough to receive an adjustment. As a result, the baseline loan limit applies to all counties in that local area.

The United States has over 3,000 counties or county-equivalent jurisdictions. In any given year, roughly 100 to 200 of them qualify for high-cost limits that exceed the baseline limit.

Minor rounding happens for baseline and high-cost area loan limits. Baseline loan limits have been rounded down to the nearest $50 and the high-cost area loan limits have been rounded down to the nearest $25.

Alaska, Hawaii, Guam, and the U.S. Virgin Islands are granted loan limits that, at minimum, are 50 percent above the country’s baseline limit. That is—the baseline loan limit for these prespecified select areas is 150 percent of the national baseline.

Fannie Mae and Freddie Mac occasionally acquire loans originated in previous years. The loan limit for those “seasoned” acquisitions depends on a loan’s year of origination, physical location, and number of units. Under a series of previously enacted laws (including the Economic Stimulus Act of 2008, the American Recovery and Reinvestment Act of 2009, Public Law 111-88, and Public Law 111-242), higher conforming loan limits apply to Fannie Mae and Freddie Mac acquisitions of certain seasoned mortgages in 2019. Loans acquired in 2019 that were originated between July 1, 2007, and Sept. 30, 2011, will be subject to previously announced limits determined under those laws. The applicable loan limits for such seasoned loans are as high as $729,750 for one-unit properties in the contiguous United States (that was temporarily set to 175 percent of the baseline from 2008 until 2012).

The CLLs webpage, available at https:/www.fhfa.gov/CLLs, provides information about loan limits and links to helpful documents and tools.

Annual loan limits for every county are provided online at https:/www.fhfa.gov/CLLs in spreadsheet (XLS) and document (PDF) formats. These files provide county limits based on the number of units (1 to 4) in a property and reflect HERA provisions. A table of historical loan limits is provided in an annual report to Congress and it can be found here.

CLLs are based on the county where a property is located. Some properties, however, may benefit from belonging to a core-based statistical area (CBSA) where other counties have higher median home values. In such cases, the limits are set using the county with the highest median price and they are the same for every county in the CBSA.

A CBSA refers to either a metropolitan statistical area or a micropolitan statistical area. CBSAs comprise the central county or counties containing a large population core, plus adjacent outlying counties having a high degree of social and economic integration with the core. This forms the statutory definition of “local areas”. For more information see 2010 Standards for Delineating Metropolitan and Micropolitan Statistical Areas here: https://www.govinfo.gov/content/pkg/FR-2010-06-28/pdf/2010 15605.pdf.

FHFA uses the revised Metropolitan and Micropolitan Statistical Areas and Divisions as defined by the Office of Management and Budget (OMB) in March 2020 which can be viewed at https://www.whitehouse.gov/wp-content/uploads/2020/03/Bulletin-20-01.pdf. OMB is not expected to make another set of revisions until June 2023.

FHFA uses the most current CBSA definitions and does not assign properties into prior delineations that might have been utilized during an earlier transaction year. As an example, a recent set of delineation changes is outlined in the 2018Q4 FHFA HPI report where a Technical Note explains the transition to new definitions which impacted multiple metropolitan statistical areas. The latest delineation bulletin only added a single micropolitan statistical area which is now incorporated into the CLLs process.

Not anymore. VA home loan limits were the same as the Federal Housing Finance Agency (FHFA) limits until January 1, 2020. With the passage of the Blue Water Navy Vietnam Veterans Act of 2019, veteran borrowers are no longer limited to the FHFA CLLs.

The Blue Water Navy Vietnam Veterans Act of 2019, Public Law 116-23, was signed into law on June 25, 2019. The law took effect January 1, 2020 and states that VA-guaranteed home loans will no longer be limited to the Federal Housing Finance Agency (FHFA) Conforming Loan Limits. Veterans will be able to obtain no-down payment VA-backed home loans in all areas, regardless of loan amount. For more information on the Act, see https://benefits.va.gov/homeloans/bwnact.asp.

Contacting VA directly is the best course of action to get answers about guaranty questions, the lending process or other matters related to the VA. Their webpage has information at https://www.va.gov/housing-assistance/home-loans/loan-limits/. To speak with a VA Loan Specialist or find the nearest VA Regional Loan Center call (877)-827-3702.

FHA loans are not limited by the baseline FHFA CLLs but they are based on the values. FHA calculates forward mortgage limits based on the median house prices in accordance with the National Housing Act. These limits are set at or between the low-cost area and high-cost area limits based on the median house prices for the area. Low-cost area mortgage limits are set at 65 percent of the national conforming limit High-cost area mortgage limits are set at 150 percent of the national conforming limit

FHA publishes a separate Mortgagee Letter to cover claim amounts for home equity conversion mortgages (HECM).

For more information on current FHA loan limits, see https://entp.hud.gov/idapp/html/hicostlook.cfm. For more information on FHA mortgage limits, see https://apps.hud.gov/pub/chums/file_layouts.html.

The USDA’s Rural Housing Services (RHS) has loan limits and requirements that differ from other government programs and depend on the program being utilized. For example, the Single Family Home Loan Guarantee Program requires a property be in a rural area. Additional eligibility requirements account for factors like household size and income (being below 115% of area median income), owner occupancy, borrower immigration status, and the inability to obtain certain other financing. The Single Family Housing Direct Loan Program limits the county-level area loan amount to not exceed 80% of the local HUD 203(b) loan limits. For more information on USDA’s Guarantee Loan program, the webpage, program fact sheet, and a map can be viewed at: • https://www.rd.usda.gov/programs-services/single-family-housing-guaranteed-loanprogram • https://www.rd.usda.gov/sites/default/files/fact-sheet/508_RD_FS_RHS_SFHGLP.pdf • https://www.rd.usda.gov/files/RD-GRHLimitMap.pdf F0r more information on USDA’s Direct Loan program, see the webpage, fact sheet, and map at: • https://www.rd.usda.gov/programs-services/single-family-housing-direct-home-loans • https://www.rd.usda.gov/sites/default/files/factsheet/508_RD_FS_RHS_SFH502Direct.pdf • https://www.rd.usda.gov/files/RD-SFHAreaLoanLimitMap.pdf

The VA Renovation Loan brings together some of the most innovative and attractive features of several popular mortgage programs. It provides no money down financing that covers not only the current value of the property, but the cost of remodeling and repairs as well. This program is intended for minor updates and work done on the home, with no minimum or maximum renovation cost requirement. Program overlays and eligibility during the pandemic include:

- Conforming Loan Limits only

- If Refinance transaction, limited to 100% LTV

- Home must be habitable during renovation,

Because the Veteran Administration requires that a property meet minimum property standards in order to qualify for VA financing, it is not uncommon for deals to fall through during the inspection phase. The seller may not want to pay for all the repairs needed to ensure the home meets the VA’s high standards. With a VA Renovation Loan the buyers may be able to move forward with the purchase of a home they love, while borrowing the additional funds needed to fix the issues with the property, still with zero down payment. The Veterans Administration generally requires an annual fee of $100 per third party originator for each entity that sponsors their origination. AFR pays this fee on behalf of its brokers and correspondents on AFR-related VA loans!

VA Renovation Loan Basics

- Purchase and Refinance Options

- Maximum renovation cost of $100,000

- Used to finance minor remodeling and non-structural repairs

- Renovations greater than $50,000 require a 203(k) HUD Consultant

- Fully Amortizing Fixed Rate

- 10 year, 15 year, 20 year, 25 year, and 30 year term options

- One or Two Unit Homes

- Primary Residence Only

100% Financing

VA mortgages offer one of the only no money down home financing options available in the marketplace. This is a huge advantage to qualifying veterans, military personnel, and their families, who can become homeowners without waiting many years or depleting their savings.

Low Mortgage Rates

The VA Renovation Loan makes it possible to finance both the purchase or refinance of a home and the cost of repairs or updates in one low rate, first mortgage loan. This can offer considerable savings when compared to a higher rate second mortgage, using other types of credit such as credit cards, or a home equity line of credit with a variable interest rate that could increase over time.

As with any VA loan the borrower must be a qualifying active duty member of the US military, veteran, or surviving spouse. Other requirements of this program include:

- Repairs must be minor remodeling or cosmetic in nature and not on the list of ineligible repairs

- Construction must be completed within four months of closing

- Only one General Contractor may be used

- General Contractor must be registered with the VA

- General Contractor must carry sufficient insurance through a current general insurance liability policy

- 620 minimum FICO score (640 Minimum Qualifying Credit Score for all qualifying borrowers when the loan amount is exceeding the VA county loan limits.)

Borrowers will also need to meet the income, asset, and minimum property standard requirements of VA loans. There are geographic restrictions associated with this program, rendering the following states ineligible:

- Alaska

- Hawaii

AFR does not operate in the states of Hawaii and Alaska and does not permit loans with a subject property in Hawaii or Alaska.

This can be an ideal program for veterans or military personnel who want to purchase a fixer upper while also taking advantage of the 100% financing option available to them as a result of their service to our country. Military families often move frequently as they take on new assignments throughout the career of the service member(s). When relocating to a new part of the country, especially on a short timeframe, it may be challenging to find a home that meets the needs of the buyers. Trying to purchase in a particular school district, close to base where there is the support of other military households, or within commuting distance of a spouse’s new employer can make things even more difficult. Opening the search to include properties in need of a few repairs or updates can make it much easier to find that ideal home. The VA Renovation Loan can also come into play on transactions where it was not part of the original plan. As touched on earlier it can be used to save the deal when issues are discovered through the inspection. Perhaps the potential buyers have found a home they love, in the perfect location, but the home inspection reveals that the roof is in need of repair. The would-be buyers may not be able to afford to pay for the work out of pocket, and the sellers might feel they could easily sell the home as-is in the current market and are not offering to cover the cost of fixing the roof. The home will not qualify for VA financing until the repairs are complete. A VA Renovation Loan might be a great fit in this scenario, allowing the buyers to borrow the additional funds needed to pay for the roofing work, and saving them from beginning again in their search for a new home.

Buying a Home with a VA Renovation Loan

When purchasing a property with a VA Renovation Loan the plans for the work, including information on the general contractor, are evaluated with the other documentation during the underwriting phase. An appraisal will show the value of the home both before and after the renovation is complete. Once the work is finished there will be a final certification by a VA Inspector to ensure the home meets the property standards and is ready to be enjoyed by its new owners.

VA Renovation Loan Refinancing

Consumers are often surprised to learn that renovation loans, including the VA Renovation Loan, can also be used to refinance an existing mortgage. This can be an excellent alternative to a second mortgage or cash-out refinance* when the funds will be used to repair or update the subject property.

Other Programs to Consider

If the VA Renovation Loan is not an ideal fit for a particular scenario here are a few other products to explore:

- For larger structural updates: FHA Standard 203(k) Loan

- To finance luxury projects such as installing a pool or outdoor kitchen: Fannie Mae HomeStyle® Renovation Mortgage

- Streamlined, simplified VA refinance option if repair costs are not needed: VA Interest Rate Reduction Refinance Loan (IRRRL)

You may need to make a down payment if you’re using remaining entitlement and your loan amount is over $144,000. This is because most lenders require that your entitlement, down payment, or a combination of both covers at least 25% of your total loan amount. So if you’re able and willing to make a down payment, you may be able to borrow more than the county loan limit with a VA-backed loan. Remember, your lender will still need to approve you for a loan. The lender will determine the size of loan you can afford based on your:

- Credit history

- Income

- Assets (items of value such as savings, retirement, and investment accounts)

We don’t require a minimum credit score, but some lenders may have different credit score requirements. Be sure to contact more than one lender to compare. Note: You may have heard the terms additional entitlement, bonus entitlement, or tier 2 entitlement. We use these terms when we communicate with lenders about VA-backed loans over $144,000. You won’t need to use these terms when applying for a loan.

This line on your COE is information for your lender. It shows that you’ve used your home loan benefit before and don’t have remaining entitlement. If the basic entitlement listed on your COE is more than $0, you may have remaining entitlement and can use your benefit again. On your COE, in the table called Prior Loans charged to entitlement, we list the amount of your entitlement you’ve already used under the Entitlement Charged column. Your entitlement can be restored when you sell your property and pay your VA-backed loan in full, or repay in full any claim we’ve paid.

Find the VA home loan limit for the county your property (or future property) is in.

2022 VA home loan limits

VA home loan limits are the same as the Federal Housing Finance Agency (FHFA) limits. These are called conforming loan limits. Check current loan limits

The VA-backed home loan limit refers to the amount we’ll guarantee (the maximum amount we’ll pay to your lender if you default on your loan). We don’t limit how much you can borrow to finance a home.