Homeowners who are veterans have unique financial challenges from transitioning to civilian life to making mortgage payments. Unfortunately a new home mortgage reduction program isn’t changing that. Veterans potentially saving up to $42,000 will only happen in a case where their va loan rate and payment are less for the loan to actually equate to savings.

You must do your homework to see this by reviewing two or 3 estimates and comparing everything. There are no new initiatives that reduce financial burdens so that those who served our country are supported even more during the home-buying process.

Don’t forget that as a Veteran you are also protected on a sales contract where your financing is dependent on approval of your va loan. Not having mortgage insurance can be a very big benefit, but you must add up that cost a compare it to the cost of having a VA funding fee not all veterans have a VA funding fee.

If you meet the required VA disability then you may not have a VA funding fee. Therefore you may have even more saving. If you do have a VA loan funding fee then the savings will be less but could still be less expensive compared to PMI or MI. That is something you need to verify because every person and loan is unique to the situation. Keep in mind that people with lower credit scores and higher risk might have higher mortgage insurance payments on FHA and conventional loans. There are many variables and this is not a one-size-fits-all. Make sure you’re comparing apples and apples.

This article will discuss the $42,000 mortgage reduction program myth, who is eligible for a va loan, benefits, and how veterans can get the best opportunity.

Understanding the $42,000 Mortgage Reduction for Veterans

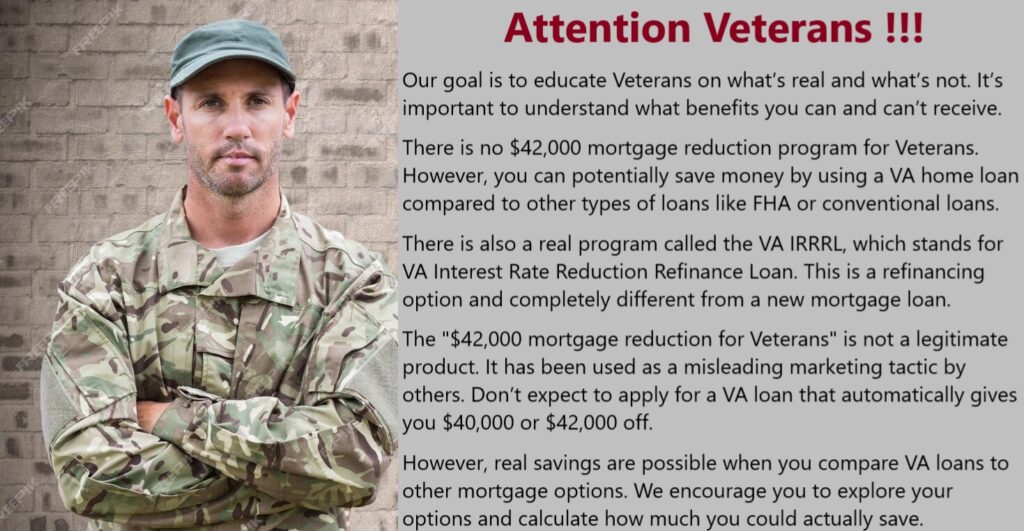

The $42000 isn’t a mortgage reduction program and it’s not a one-time financial grant program designed to help veteran homeowners with their mortgage costs. Specifically, this supposed relief takes the shape of forgiveness of loans, refinancing options, or issuing grants by the government. This isn’t true but has been spread all over the internet.

Veterans with high mortgage payments, those in tough financial situations, and anyone wanting to clean up their loan-to-value ratio definitely are often lead to believe they will benefit from this supposed program. Don’t fall into this trap

Key Benefits of the VA home loan Program

This mortgage reduction program has multiple benefits for qualified veterans, such as:

- Lower Monthly Payments are possible with VA loans compared to various other home loans: Reducing the principal balance of a mortgage means that veterans can enjoy significantly lower monthly payments if they do a interest rate reduction loan and the rate is low enough to justify the cost. If successful that helps with giving them more money for all of the necessities in their life.

- Increased Home Equity: This is s only accomplished by getting a lower interest rate with a lower payment, Principal reduction and the property going up in value. You can’t get a 42000 mortgage, 40,000 reduction or any mortgage reduction that isn’t a legit program backed by the VA and offered by a VA approved lender. Feel free to talk to a VA loan specialist like Jason Noble or Mark Vela to get a better understanding of what might be best for you and your family.

- Better Loan Terms should always be negotiated: Certain veterans with high credit and low dti may be eligible for lower refinance options with lower interest rates, which can also reduce financial strain.

- Government Support: The Department of Veterans Affairs is your best source for all true va loan programs. Many Veterans don’t realize a VA renovation loan and VA construction loan exist. True home loan programs are endorsed by governmental organizations such as the Department of Veterans Affairs (VA) and the Federal Housing Administration (FHA), thus instilling credibility and trustworthiness.

Eligibility Criteria for the $42,000 Mortgage Reduction

Veterans who wish to take advantage of this program must qualify for one or more of these eligibility requirements. Although requirements differ by program most programs request the following qualifications:

- Veteran status: Applicants must be active-duty service members, veterans or surviving spouses of veterans.

- VA-Backed Mortgage: Most programs are for veterans who already have a VA home loan or for those willing to refinance under VA programs.

- Financial Hardship: Certain programs will need proof of financial struggle, like job loss, medical expenses or other economic hardships.

- Primary Residence: The home must be a primary residence of the veteran.

- Loan-to-value ratio: Cautionary reductions are offered based on the loan-to-value (LTV) ratio, or the mortgage balance versus the market value of the home.

How to Apply for the Mortgage Reduction of $42,000

You cannot apply for a program that doesn’t exist but you can apply for a va loan and likely save compared to alternatives if you’re a Veteran with honorable discharge. There are no specific grants that directly reduce mortgage payments for veterans, but there are various mortgage assistance programs available through the Department of Veterans Affairs (VA) that can help veterans manage their mortgage payments and avoid foreclosure. These programs include counseling and options such as repayment plans and special forbearance. Although mortgage reduction opportunities are not out there for veterans, here’s how to find out if you’re eligible to apply for a va loan.

Government and Non-Profit Support Programs for Veterans

Federal and non-profit organizations that offer mortgage relief and reduction programs to veterans include:

- VA Loan Modification Program: Assists veterans in modifying their current VA home loans in order to make payments more affordable.

- Principal Reduction Alternative (PRA): This component is geared towards helping eligible homeowners with a decrease in property value to find relief in the form of some forgiveness or reduction of their loan balance.

- Special Forbearance Agreements: relief for veterans about to face a temporary short-term financial hardship; so they can avoid an immediate foreclosure.

- State Home Buyer Programs: Many states have additional mortgage relief programs for veterans.

- Non-Profit Organizations: Organizations such as Operation Homefront and the Military Warriors Support Foundation offer veterans financial help and mortgage-free homes.

Other Resources for Mortgage Assistance

Other options may be available to a veteran who doesn’t qualify for the $42,000 mortgage reduction program, for example:

- VA Streamline Refinance (IRRRL): This option is for veterans looking to refinance their current VA loan into a lower rate and reduce their monthly payments.

- Loan Forbearance: A temporary measure to suspend or reduce mortgage payments for veterans with financial hardships.

- Debt Counseling Services: Non-profit credit counseling agencies can help veterans come up with payment plans that fit their budget.

- Sell or Downsize: If servicing a large mortgage is untenable, veterans might explore selling or downsizing to a more affordable residence.

The Impact of the $42,000 Mortgage Reduction on Veteran Homeowners

To many veterans, it is the pathway to financial security and stability. This $42,000 mortgage reduction will make a significant difference for veterans and their families by:

- Mitigating financial stress and anxiety over their mortgage.

- Making long-term home affordability and sustainability better.

- This can be a vehicle to accumulate home equity and create wealth.

- Improving the quality of life for veterans by providing stable housing.

How can veterans get assistance if they are unable to pay their mortgage and may be facing foreclosure?

Veterans finding it hard to make mortgage payments and facing potential foreclosure on a VA-backed loan should immediately contact their loan servicer, and if assistance is needed, reach out to the VA at 877-827-3702 or visit the VA website.

Here’s a closer look at how veterans can receive help:

- Contact Your Loan Servicer: The first thing you should do is get in touch with the company that services your VA-backed loan and explain your situation.

- VA loan technicians: If you’re having difficulty getting the assistance you need from your servicer, or if you’d just like advice, you can call a VA loan technician at 877-827-3702.

- The VA Regional Loan Centers have counselors who can provide financial counseling to help veterans keep from defaulting on their loan.

- Avoid Foreclosure with VA Loan Technicians: VA loan technicians can help you figure out a solution, including refinancing, loan modification, or other possible options.

- VA Homeowner Assistance Fund (HAF): The HAF also includes assistance that helps prevent mortgage delinquencies, utility loss, foreclosures, and displacement from the home as a result of financial hardships.

- Veterans Affairs Servicing Purchase (VASP) Program: The VASP is a last-resort solution for homeowners who have tried everything else.

- Explore Other Resources: Reaching out to groups such as the Disabled American Veterans (DAV) or the National Coalition for Homeless Veterans can provide you with additional information and help.

Beware of Scams:

Be wary of foreclosure relief scams and phony legal assistance, and research the legitimacy of any arrangement for help before signing on the dotted line.

Final Thoughts

This $42,000 mortgage reduction program for veteran homeowners is a transformative chance to give veterans a much-needed financial break. This initiative helps those who served our nation maintain housing stability by lowering mortgage payments, increasing home equity, and preventing foreclosure.

Veterans must take proactive steps to research eligibility requirements, engage with the VA or mortgage lenders, and take advantage of government resources. This ensures that they will reap the full rewards of this program and succeed in homeownership in the long term.

This means for veterans looking for mortgage help, the time to act is now. Contact the VA, mortgage lenders, or non-profit organizations to begin your path toward financial relief and security in homeownership today!