VA Loan Guide

No mortgage insurance

Since the VA guarantees the lender the top 25 percent of the loan, no mortgage insurance is required. Most conventional loans require a borrower to put down at least 20 percent of the purchase price or pay mortgage insurance. Mortgage insurance can be costly and does not ever go towards reducing your principal balance.

Lower Interest Rate

Because the Department of Veteran Affairs guarantees each loan, interest rates are typically 0.25 to 1 percent lower than those of conventional loans.

No Down Payment For VA Loans

Saving enough money for a down payment can be especially difficult for active duty service members who are moving from base to base. Since there is no down payment required for a VA Home Loan, many veterans can purchase a home with little to no money out of pocket.

Who is Eligible?

Service Members and Veterans of the United States Military serving our country earn their VA Home Loan Benefit. The eligibility requirements vary depending on the type and character of your service…

The Many Benefits

The Loan Program offers less restrictive guidelines and more underwriting flexibility than other types of loan products making it easier to qualify…

The Loan Process

Service Members and Veterans of the United States Military serving our country earn their VA Home Loan Benefit. The eligibility requirements vary depending on the type and character of your service…

Need more? Jumbo VA loan

A Jumbo VA loan is any VA loan greater than $417,000. Qualifying veterans can apply to purchase or refinance their home for up to a value of $1,000,000 through this type of loan…

VA Loan Refinance

With a VA Cash-Out Refinance, you have the ability to turn up to 95% of their home’s equity into cash…

Obtain Your COE

Security America Mortgage is also happy to assist you in obtaining your Certificate of Eligibility. Since we have access to the Web LGY system we are able to establish eligibility and issue an online COE in a matter of seconds…

Veterans don't need a Down Payment And Assets

to qualify for a VA Home Loan

The VA home loan is one of the best VA benefits because it enables Veterans to buy a home, build a home, and renovate a home without a downpayment. There are no specific asset requirements in regards to your eligibility for a va home loan. However, a Mortgage lender will want to see that you have enough cash on hand to cover the closing costs. Use our VA home loan affordability calculator for an estimate to save time!

In addition to cash, we may also want to see that you have other assets, such as savings accounts, retirement accounts, or investment accounts. These assets can help to demonstrate your financial stability and ability to repay the loan.

Here is a list of some of the assets that may be considered by lenders when underwriting a VA loan:

- Cash

- Checking accounts & Savings accounts

- Retirement accounts like 401Ks, IRAS, SEPS, and SIMPLE plans

- Stocks & Bonds & Investment accounts

- Real estate owned can add to your expense ratio if you have payments but your equity strengthens your financial profile.

- Life insurance policy

- Cars, although they don’t help with liquidity if owned outright they are assets that slightly enhance your financial picture.

It is important to note that we will not require you to have all of these assets in order to qualify for a VA loan. However, having a good amount of assets can help to improve your chances of getting approved for a loan and getting a better interest rate.

If you are considering your eligbiilty for a VA home loan, it is a good idea to talk to a VA Loan Specialist about your specific situation. We are here to help you figure out home much house you can afford VA. Our VA Home Loan Affordability Calculator will be helpful to get started with a monthly budget breakdown.

VA loan closing costs

Closing costs can vary depending on the sales price, the state, the down payment, and the loan amount, but they typically range from 3-6% of the loan amount. Utilize our va loan calculator and va loan affordability calculator.

Some common closing costs associated with VA loans are:

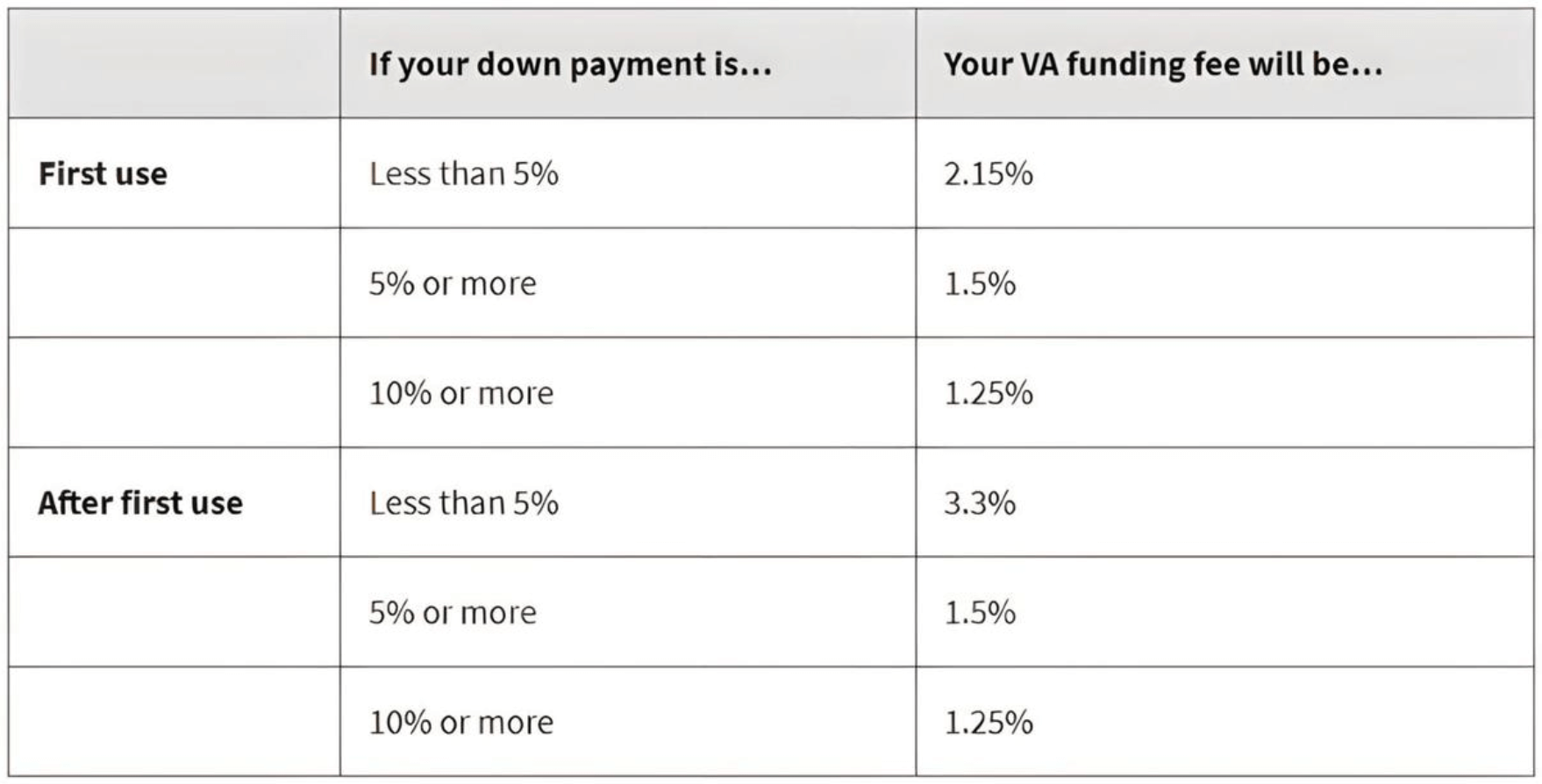

- VA funding fee is a one-time fee that is charged to eligible Veterans who use the VA loan benefit. VA funding fees are based on the loan amount and your military service status. For example, the VA funding fee for a Veteran first-time homebuyer with no down payment is 2.15% of the loan amount.

- The loan origination fee is a fee charged by Security America Mortgage to cover the costs of processing the loan. The fee is typically 1% of the loan amount, but it can be higher or lower depending on the type of VA loan.

- VA Appraisal fee is a fee charged by an appraiser to determine the value of the property. The fee is typically $400-$600.

- Title insurance protects you from title defects. The cost of title insurance varies depending on the state, but it is typically around $1,000.

- Recording fees are charged by the county to record the deed and mortgage. The fees are typically around $100-$200.

- Other closing costs on VA loans include taxes, insurance, and attorney fees.

The good news is that you may be able to negotiate with the seller to pay some of the closing costs. The VA allows sellers to pay up to 4% of the purchase price in closing costs. However, to get that it’s important you have a Military friendly Real estate agent helping you by asking the seller for this contribution. Don’t forget that if the seller is essentially reducing their sales price by making less. If the seller has a contribution built into their sales price then there is a chance the home doesn’t appraise for the sales price. In this case, the seller would be asked to lower the price to the appraised value.

Nonallowables

- Commission for real estate professionals

- Brokerage fee

- Buyer broker fee

- Termite report (unless you’re using a refinancing loan)

Closing costs are negotiable between Eligible Veterans and Sellers

- VA funding fee

- Loan origination fee

- Loan discount points or funds for temporary “buydowns”

- Credit report and payment of any credit balances or judgments

- VA appraisal fee

- Hazard insurance and real estate taxes

- State and local taxes

- Title insurance

- Recording fee

The max seller contribution on a VA loan

- Sellers can pay up to 4% of the loan amount in the seller’s concessions, but this only applies to certain closing costs, such as the VA funding fee. Loan discount points don’t count in the 4% because Loan discount points are not considered customary closing costs.

VA loan requirements in 2023

Nothing has changed on VA loan requirements in 2023. A Veteran is still someone that has served on active duty in the U.S. military for at least 90 days, or for any length of time during a war or campaign. You must have your Certificate of Eligibility (COE) that proves you are eligible for VA Mortgages. You can get your COE from VA.gov or allow Security America Mortgage to obtain it rapidly directly through the VA Portal. A DD-214 is proof of your active service and is always needed by mortgage companies.

The VA does not have a minimum credit score requirement but Security America Mortgage does and so do other VA lenders. Most lenders require a credit score of at least 620 for a VA loan. It’s essential that you have the supporting income to qualify with any VA lender. If you only have a 600 then you aren’t far away and we’ll provide you guidance so that you can have a credit score that qualifies. Even if your score is under 600 we can help you with a game plan to get your score higher for qualification.

The property you want to buy will be assigned to a VA appraiser and must appraise for at least the amount of the loan. If it doesn’t you can negotiate with the seller to lower the price or walk away from the deal because real estate contracts usually protect Veteran buyers when the property doesn’t meet value.

Debt-to-income ratio

VA loans are run through AUS which stands for automated underwriting system. Security America Mortgage uses it to evaluate your eligibility for a VA home loan. The AUS uses a variety of factors to determine a borrower’s risk, including credit score, debt-to-income ratio, and employment history. We can issue you a preapproval letter when we recieve an AUS approval. Of course, then your file goes through underwriting to make sure all the data in your loan application is correct. AUS will give a false approval if you have false information in your loan application and this will get caught during underwriting. If we don’t get an automated approval we’ll consider a manual approval if their are extenuating circumstances. A good rule of thumb is that you should have a DTI under 41% but that doesn’t mean you wont get an AUS with 43% if your loan risk is mitigated by having cash reserves, excelent credit, a down payment or other compensating factors like assets. DTI is calculated by dividing your monthly debt payments by your gross monthly income.

Cash reserves

Reserves are liquid assets that can be used to cover unexpected expenses, such as a job loss or a medical emergency. They can include things like cash, savings accounts, and money market accounts and they help ensure that borrowers have enough money to cover their monthly mortgage payments if they lose their job or experience another financial hardship. Reserves aren’t required on VA loans by the VA and if you get an AUS approval with low reserves or no reserves that would likely be due to you have a low DTI.

Property Requirements for VA loans

The VA has a set of minimum property requirements (MPRs) that must be met for a property to be eligible for a VA loan. Requirements are designed to ensure that the property is safe, sanitary, and structurally sound. The MPRs cover a broad range of factors, including:

- The condition of the roof, heating, and cooling systems, and electrical wiring

- The presence of lead-based paint

- The condition of the foundation and structure

- The availability of clean water and sanitary facilities

- The property’s location in a floodplain or other hazardous area

If a property does not meet the MPRs, it may not be eligible for a traditiional VA loan but consider a VA renovation loan or asking the seller to make the required repairs.

VA funding fee in 2023 for a VA construction loan and a VA home loan

Many disabled Veterans are exempt from the VA funding fee. If you are eligible for VA compensation for a service-related disability, and you are currently receiving retirement or active-duty pay you are likely exempt. Further, if you are receiving Dependency and Indemnity Compensation (DIC) from the Department of Veterans Affairs as the surviving spouse of a Vet you’re probably exempt. Further, you are likely exempt with a pre discharge claim if you are active duty and received a proposed memorandum rating before we close on your va loan. Purple Heart recpients and Veterans with a 10% or higher disability are also exempt.

VA home Loan Benefits

- VA loans have no maximum loan amount for first-time home buyers set by the VA. You can borrow up to the full appraised value of the property if you qualify according to the VA. Subsequent user limitations, high-cost areas, and other factors do come into play.

- VA loans have no monthly mortgage insurance aka private mortgage insurance PMI

- VA loans have more flexible underwriting standards when it comes to credit and your last 2 years of credit history are most important.

- No down payment requirement

What Types of VA Loans are Available in 2023?

- VA home loan to purchase

- VA renovation loan

- VA construction loan

- VA one-time close construction loan

- Construction loan with permanent VA loan after construction is completed

- VA IRRL

- VA conversion loan

- VA Land loan through state sponsors like Texas Veterans LandBoard TVLB

- Jumbo VA loan

- Native American direct loan

- VA cash-out refinance that’s not available in Texas but in participating states.

VA Loan Benefits include subsuquent usage even with an existing va loan

You can have 2 VA loans at the same time but only one can be your primary residence. For example, it’s ok if you bought a home and have an active va loan and years down the road you decide to rent that home out and build a home Your amount of entitlment has changed but it is possible to have 2 va loans at the same time. We are grateful there is no va loan limit on how many times you can use your va loan benefit. Although, the amount of entitlement that a Veteran has will be reduced each time they use a VA loan. Entitlement is the amount of money that the VA will guarantee on VA home loans. If a Veteran uses all of their entitlement, they will not be able to get another VA loan unless they restore their entitlement. There are a few ways to restore full va loan entitlement. Get a one-time restoration of your full VA loan entitlement from the VA or pay off your VA loan. Don’t forget that entitlement is not the same as a down payment and can’t be transfered.

Apply for a VA home loan

Getting pre-approved first before starting the home or builder search makes the most sense for you, your real estate agent or your builder. Security America Mortgage is proud to offer one of the most technologially advanced loan applications because it helps ensure a smooth process. We utilize 3rd party software and you can apply now with our most seasoned Loan Officer and COO, Jason Noble. If you’re not ready go ahead and estimate your loan preapproval amount based on your income and expenses with our va home loan eligibility calculator.

Certificate of Eligiblity automated request

Security America Mortgage has credentials to access va.gov and will get your automated Certificate of Eligibility COE. To do it on your own go here COE at the Veteran Affairs

COE Process

- Veterans must have a copy of their discharge or (DD214).

- Active-duty service members need a statement of service—signed by their commander, adjutant, or personnel officer with the following information:

- Your full name

- Your Social Security number

- Your date of birth

- The date you entered duty

- The duration of any lost time

- The name of the command providing the information

VA loan with a low credit score criteria

The Department of veterans affairs doesn’t actually set credit score requirements. Security America Mortgage goes by your AUS/Automated Undrewriting System Findings and so do other Lenders. 620 is usually the lowest accepted but there isn’t anything set in stone. We will do everything we can to help you qualify.

VA mortgage rates on va home loans

VA mortgage rates are always changing and it’s best to get a quote each day. It also depends on the va loam program you choose and the day you lock in your rate.

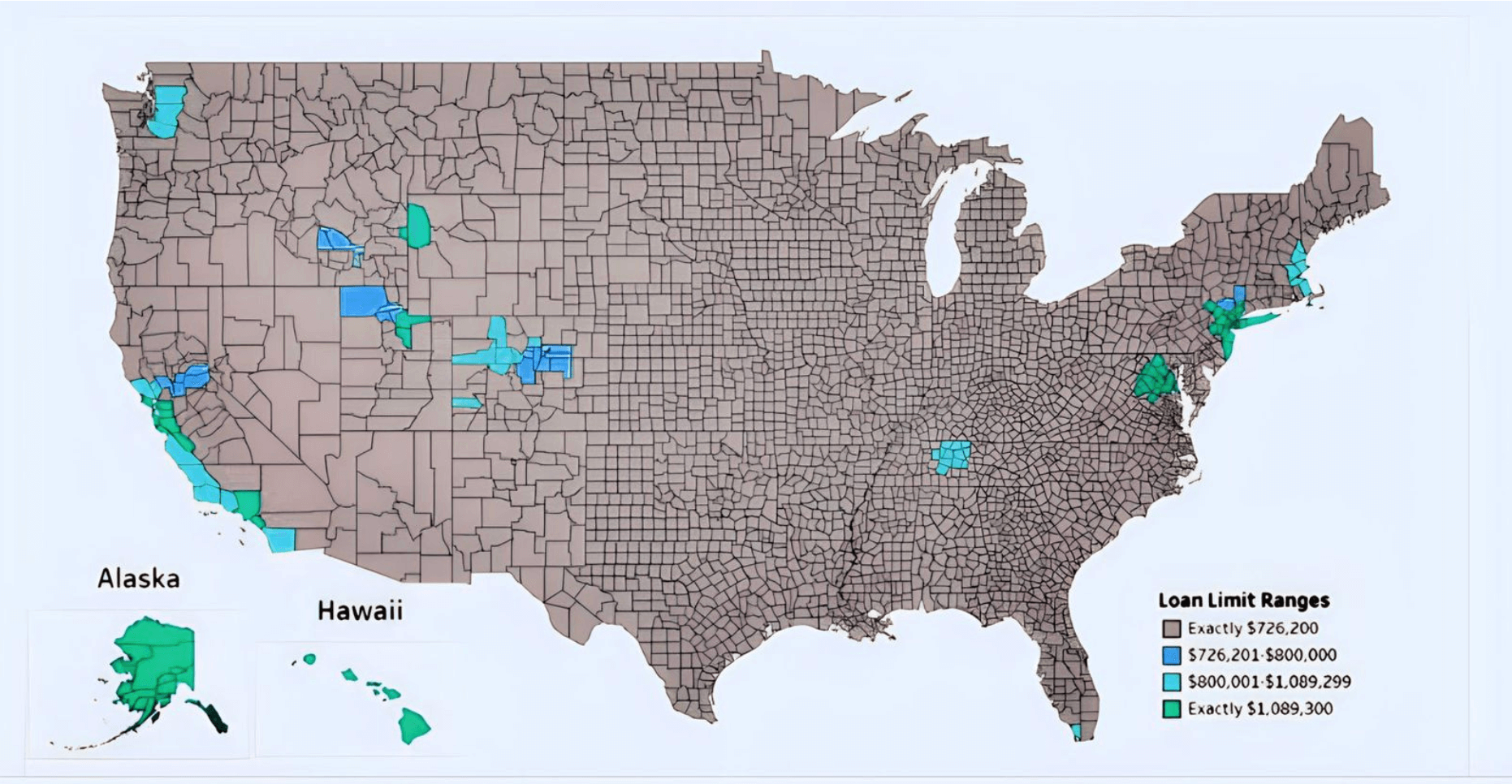

VA loan limits in 2023 Map

$1,089,300 in 2023 is a high cost area. If the median home price exceeds 115% of the national conforming loan limit then it’s a high-cost area. $726,000 for subsuquent users without full entitlement in most areas with an avergage cost of living. There is no cap on the va loan amount for Veteran first-time home buyers set by the Veterans Affairs but all Lenders make their own decision. $726K is also the conforming loan limit set by the Federal Housing Finance Agency (FHFA). There are a few areas in metropolitan cities that are high-cost areas. The map below provides an example.

Jumbo VA loan

The VA home loan amount max is higher than conforming loan limit in some areas because the VA guarantees some of the VA home loan program, which reduces the lender’s risk. This allows Private lenders to lend more money to Veterans in high-cost areas. Use our VA home loan affordability calculator to see if you can handle a Jumbo VA loan!

VA loan process for first time home buyers without a current va mortgage

- Get your COE and confirm your VA loan eligibility

- Apply for a VA home loan after you check out our va home loan affordability calculator

- Get pre-approved for your VA home loan benefit with us.

- Find a real estate agent that is Military friendly

- Shop for homes that are in your budget with your pre appoval letter handy to present to sellers

- Make multiple offers if that helps you get the best deal. Make sure you have a Realtor who will fight for you like Carlos Say of Security American Realty.

- Make a deal when you find the one!

- Do your due diligence during the option period and back out of the deal if there are issues.

- Get an inspection immediately after getting under contrac.t

- Make sure another home hasn’t come on the market that’s better for you.

- Make your VA loan application is progressing by getting frequent updates from your Loan Officer

- Let us provide you a competitive interest rateVA loan rates fluctuate so you’ll have to have your rate locked.

- Go through VA loam underwriting.

- Get a UW VA loan approval.

- Close with your VA-approved lender on your VA loan.

- Get your keys the day of funding of your VA loam.

VA Construction Loan One Time Close process

- Let us confirm your VA loan eligibility and pre-approve you to buy and build at the same time so that you have 2 great options. Having 2 options in today’s market will help you get the best deal.

- Start looking for land and a builder.

- Consider plans and start making them with your VA registered and SAM approved builder.

- The process can be easier if you acquire land before starting the va construction loan process because your loan is easier if you already own land.

- The Texas Veterans Land Board does VA land loans in Texas and they are one of a kind. If you’re in a different state land loans are typically done by local banks or through an entitiy similar to TVLB.

- Land loans usually have a 20% down payment requirements and your VA loan eligibility doesn’t come into play.

- Banks that do land loans don’t usually offer the VA one-time close construction loan

- If you want to buy land and close on your VA construction loan at the same time it’s important that your contract to buy land gives you time to close on the land and VA construction loan at the same time. If you get under contract to buy land and have 30 days to close, no builder and no plans; don’t expect to get a va construction loan approved that quickly. Approved plans are essential to close on the land and construction loan at the same time.

- When you have an approved va builder with the final plans approved, land owned or in contract, and an approved appraisal then you are set to close on your VA one time close construction loan.

Advantages of a VA one-time close construction loan over other Construction Loans.

- One Time closing saves time.

- One Time closing saves closing costs.

- One Time closing is easier.

- One Time closing means no requalification.

- One Time closing means no payments upfront when working with Security America Mortgage.

- One Time closing means no need for a 2nd appraisal.

- One Time closing means you have a guaranteed rate and don’t have to worry about what rates will be like down the road.

Conventional loans vs VA loan rates

According to the Department of Veterans Affairs, VA loans have “competitively “low-interest rates” You might consider conventional loans when you have 20% to put down with an automated approval/AUS because you won’t have private mortgage insurance, and there is a chance your interest rate could be less than a VA loam. Rest assured we will provide you a competitive interest rate.

Eligibility for a VA Home Loan in 2023

Security America Mortgage is a unique Mortgage lender with a focus on helping Vets build the home of their dreams with a va one-time close construction loan. Some Vets find a fixer-upper home that needs rehabbing or doesnt meet the Veterans Affairs minimum property requirements and that’s when a va renovation loan comes in handy.

BAH Basic Allowance for Housing in 2023 updates

The Basic Allowance for Housing (BAH) rates for 2023 updates were released on December 14, 2022. The rates increased an average of 12.1 percent representing the largest increase in more than a decade. The increase was attributed to inflation, higher interest rates, and overall rising housing costs across the country.

The most significant changes to the BAH rates in 2023 include:

- The average BAH rate has increased by 12.1%.

- The highest BAH rate increase was for the O-10 pay grade, and they saw an increase of 14.3%.

- The lowest BAH rate increase was for the E-1 pay grade, and they received an increase of 10.5%.

- BAH for all pay grades and dependency statuses increased.

- BAH rates for certain areas, such as Hawaii and Alaska, increased more than the national average.

The BAH rates are created by the Department of Defense (DoD) based on several factors, including the cost of housing in a particular area, the number of service members in that area, and the pay grade of the service member. The DoD reviews the BAH rates annualy and makes adjustments as needed.

The BAH rates are important for service members because they help to offset the cost of inflation and housing. The BAH rates are not taxable, so they can provide a meaningful financial benefit to service members. Check out your BAH rates. Use our VA home loan affordability calculator with your BAH factored in to get better quote.

Qualify for the VA loan Benefit using your Basic Housing Allowance

Basic Allowance for Housing can be used and helpful when qualifying for VA loans. We have many active duty service members who utilize this form of income. How much house I can afford VA is a frequent first question and yet another reason we provide a va home loan affordability calculator that includes any BAH you might have.

Disabld Veterans with disability income

Disabled Veterans can use their gross disability income when utilizing their VA loan benefits.

Surviving Spouses

Surviving spouses of military service members who made the ultimate sacrifice to our great country while on active duty or as a result of a service-connected disability are eligbile for a va home loan

VA loan funding fee Refund Eligibilty

The VA loan funding fee can be refunded after closing under certain circumstances. The most common reason for a refund is if the borrower is later awarded VA compensation for a service-connected disability. The effective date of the VA compensation must be retroactive to before the date of the loan closing. If you get a proposed or memorandum rating after your loan closing date, you’ll still need to pay the funding fee. You won’t be eligible for a refund based on this rating.

- Another reason for a refund is if the borrower refinances their VA home loan with another type of loan, such as a conventional mortgage. If the VA borrower is able to get a lower interest rate on the new VA loan, they may be able to get a refund of the VA funding fee.

- The VA will also consider refunds on a case-by-case basis for VA loans where the VA borrower can demonstrate that they have experienced financial hardship as a result of the VA loan.

Request a refund of the VA funding fee in 2023 by contacting the VA Regional Loan Center or call them at 800-698-2411.

Do you prefer to talk to a home loan specialist now?

Or Call Now For Help!

We are dedicated to

serving Those who served.