FHA Loan Texas

Start the easy application process now!

"*" indicates required fields

What is a FHA Loan Texas

FHA Loans in Texas are insured by the Federal Housing Administration. Since FHA loans are insured by the government, a down payment of only 3.5% is required. FHA loans are a popular loan option for first time home buyers who have not have the savings for a 20% down payment.

FHA Loan Texas Requirements

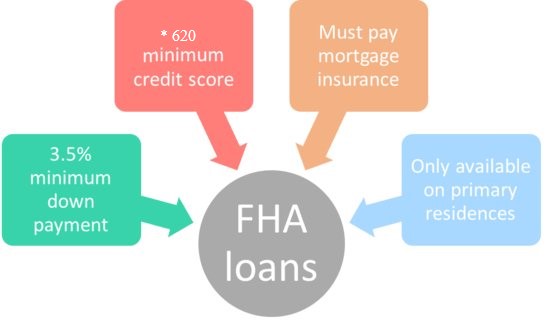

FHA loans require a down payment of at least 3.5% to qualify. While FHA does not have private mortgage insurance, government mortgage is required on all loans. Most lenders require that the borrower have a credit score of at least 620 and the amount of their mortgage payment not exceed 31% of their gross monthly income. The loan amount must be less than the FHA County Loan Limit. FHA loans can only be used to purchase a primary residence.

Benefits of FHA Loan Texas

FHA loans are a great option for first time home buyers or those how have had credit challenges in the past. Typically lower or middle-income borrowers who have not saved the 20% down payment required by a conventional loan benefit from FHA Loan’s low down payment of 3.5% to qualify.

Cost of FHA Loan Texas

FHA Loans have the same closing cost as all other loan types. FHA Loans have the additional cost of Up Front Mortgage Insurance Premiums (UFMIP) and monthly mortgage insurance. The Up Front Mortgage Insurance Premium can be rolled into the final loan if needed. An FHA Loan allows the sellers to contribute up to 6% of the purchase price towards the borrowers closing cost.

Facts

- An FHA Loan in Texas is used most often by first time home buyers who have not saved enough for the 20% down payment required by Conventional Loans.

- FHA Loans requires a down payment of 3.5%.

- FHA Home Loans allows the borrower to use a maximum of 31% of their gross income to qualify.

- An FHA Home Loan requires Up Front Mortgage Insurance Premium (UFMIP) and monthly mortgage insurance.

- With an FHA Loan, the sellers of a property can contribute up to six percent of the purchase price towards the buyers closing cost.

Our goal at Security America Mortgage is to match the best product to the needs of our clients. In addition to offering VA Home Loans, we offer FHA Home Loans. Contact us today to discuss your loan options and determine which loan is best for you!