Purchasing a home is a big financial commitment, and mortgage rates are instrumental in how affordable that commitment is. A 2-1 buydown is a way to offset the pain of high interest rates early on, during the first few years of a mortgage. This financing plan enables homebuyers to stagger their payments before acclimating to the full-interest rate of the mortgage. So, what is a 2-1 buydown, and is it right for you? Let’s look at how it works, its benefits, costs and potential downsides.

What Is a 2-1 Buydown?

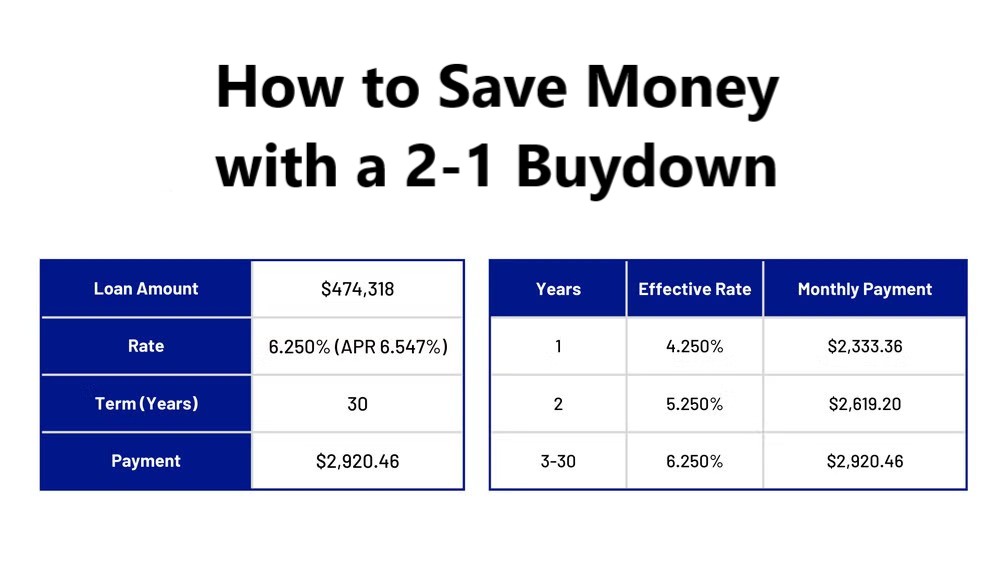

A 2-1 buydown is a type of mortgage financing where the interest rate is reduced for the first two years and then adjusted to the normal rate for the remaining loan term.

Here’s how it works:

- First Year: The rate is 2% lower than the locked interest rate Let’s say the contracted rate is 6%. You only pay interest at 4% in year 1.

- Second Year: The interest rate drops one percentage point, so you would pay interest at 5% in the second year.

- Third Year Onward: The interest rate goes back to the agreed-upon contract rate, in this case 6%.

This arrangement allows for a temporary lower payment period to make homeownership more affordable in the first few years.

Advantages of a 2-1 Buydown

A 2-1 buydown may be a good option especially for someone who is a first time home buyer or is anticipating future income increases. Here are some key advantages:

1. Reduced First Monthly Payments

There’s also the all-important first (or two!) year where a 2-1 buydown comes to your rescue with more attractive mortgage payments. That can provide financial relief while homeowners get used to their new expenses.

2. Increased Buying Power

By decreasing lower payments, this means that homebuyers could be approved for a larger loan amount, which means that homebuyers can buy a better home than they would be able to with a conventional mortgage.

3. To Be Able to Refinance in the Future

If rates go low in the first two years, they can refinance into a lower permanent before their mortgage adjusts to the standard rate.

4. So Good for Sellers and Builders

At times, sellers and homebuilders offer 2-1 buydowns to entice buyers. This can increase the attractiveness of homes in a high-interest market.

Cons of a 2-1 Buydown

A 2-1 buydown can be a great way to go, but you should be sure to weigh some of the drawbacks:

1. Payments Increase After Year 2

After the buydown period, borrowers have to expect a bump in payments. And if they haven’t been prepared for this jump, that could put a strain on their finances.

2. Upfront Cost of Buydown

The discount on the interest rate comes at a cost. Someone (the borrower, the seller or the lender) must pay a one-time lump sum up front to buy down the cost of lowering the rate.

3. Refinancing Could Reset the Buydown

If a borrower refinances before the full rate kicks in, they can forfeit the remaining benefit of the buydown, which means payments could also be higher sooner than anticipated.

How Much Does a 2-1 Buydown Cost?

The cost of a 2-1 buydown is calculated based on the difference between the standard mortgage payments and the reduced payments for the first two years.

A general formula to estimate the cost is:

Buydown Cost = (Loan Amount × Percentage Cost) / 100

For example, on a $500,000 mortgage with a 6% standard rate, the total cost of the buydown would be approximately 2.2% of the loan amount:

$500,000 × 2.2% = $11,000

This cost is typically paid at closing by either the borrower, the home seller, or the builder.

Can Veterans Benefit from a Buydown on a VA Construction Loan?

Yes! Eligible military members and veterans can use a 2-1 buydown on VA loans. This can especially come in handy for VA construction loans, which fund the construction of a house. A buydown may help reduce initial mortgage payments while the borrower [you] gets used to the new post-construction expense.

VA loans usually do not require down payments and have lower rates than conventional loans, which makes the 2-1 buydown an even better fit for veterans.

Using a Construction Loan Calculator to See the Benefit of a Buydown

Borrowers can calculate using a construction loan calculator before electing to go with a 2-1 buydown. With tools such as the Buydown Calculator, you can input the loan information and view how a buydown will impact your monthly payment over time.

Final Thoughts

For homebuyers seeking lower initial payments and short-term affordability, a 2-1 buydown can be a wonderful tool to add to the toolbox. But after the buydown period ends, you need to plan for the payment increase.

This plan can introduce added flexibility for veterans using VA construction loans to manage mortgage payments throughout the home-building process and beyond.

Before deciding on a 2-1 buydown, consider using a mortgage calculator and consulting with a financial expert to ensure it aligns with your long-term financial goals. If structured correctly, it can be a valuable way to ease into homeownership while securing a long-term investment in your future.