Mortgage Types

Our goal at Security America Mortgage is to match the best product to the needs of our clients. In addition to offering VA Home Loans, we offer Conventional, FHA, Non-conforming, and USDA loans. Whatever our clients require, we have the expertise to deliver.

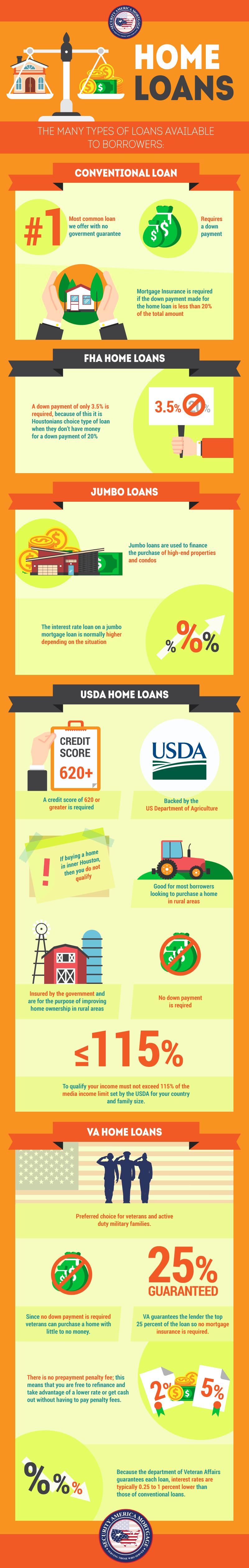

Conventional loans are the most common of all home loans. These loans are typically sold to Fannie Mae or Freddie Mac. Conventional loans do not come with a government guarantee and require a down payment. For down payments that are less than 20% of the purchase price, mortgage insurance is required. Conventional loans can be used to purchase a primary residence, second home, or investment property.

A conventional mortgage, unlike other types of mortgages such as VA, FHA, or RHS, is not guaranteed or insured by a federal government agency. If you have good credit, conventional mortgages might offer lower rates than other types of mortgages. And with a conventional mortgage, if you have at least 20% equity in your home, you might not have to pay any private, mortgage insurance. The best thing about a conventional mortgage is that anyone can apply, unlike VA Loans where only Veterans and Military Servicemembers are eligible.

FHA Loans are mortgages insured by the Federal Housing Administration. Since the government insures FHA Loans, a down payment of only 3.5% is required. FHA loans are a popular loan option for first time home buyers who have not have the savings for a 20% down payment.

If you currently have a FHA Home Loan you might be able to refinance and streamline the entire process using a FHA Streamline Refinance.The main goal of the FHA Streamline Refinance is to allow homeowners the ability to quickly reduce their interest rate and payment amount with minimum documentation required.

A jumbo mortgage is a home loan of which value exceeds conventional home loan limits which are set by Fannie Mae and Freddie Mac. Typically, jumbo mortgages are used to finance the purchase of luxury, high-end properties, homes or condos. The jumbo mortgage, conforming limit in “high-cost” areas is currently $625,500.

Jumbo Refinance

A jumbo refinance mortgage is a home loan of which value exceeds conventional refinance home loan limits which are set by Fannie Mae and Freddie Mac. Typically, jumbo refinance mortgages are used to refinance luxury, high-end properties, homes and condos. The jumbo refinance mortgage, conforming limit in “high-cost” areas is currently $625,500.

USDA Home Loans are backed by the US Department of Agriculture. Since USDA Loans are insured by the government and are for the purpose of improving home ownership in rural areas, no down payment is required. USDA Rural Development loans are a good for most borrowers looking to purchase a home outside of major metropolitan areas.

Non-conforming Loans are residential mortgages that do not conform to the loan purchasing guidelines set by the Federal National Mortgage Association /Federal Home Loan Mortgage Corporation (Fannie Mae and Freddie Mac). Mortgages which are non-conforming because they have a dollar amount over the purchasing limit set by FNMA/FHLMC are often called “jumbo” mortgages.

Start your easy loan application here

"*" indicates required fields