VA Loans in Florida: Experienced, Professional VA Home Loan Specialists Supporting Veterans

Get Pre-Qualified with Security America Mortgage

At Security America Mortgage, we’re proud to serve those who have served our country. We help veterans and their families to access affordable VA home loans to make their dream homes a reality, providing a professional, personalized experience from start to finish.

We pride ourselves on providing a service based on quality, trust, and transparency, helping you to find the VA loan that’s right for you, and supporting you in finding and buying the perfect Florida home. To date, we’ve helped 1000s of veterans access VA home loans, construction loans, and refinancing alongside a wide range of other services.

Get in touch with us today, and start on the path to securing your dream home with an affordable, accessible VA home loan.

Oops! We could not locate your form.

"*" indicates required fields

Incredible Competitive Rates on VA Home Loans: Make Your Dream Home A Reality!

Veterans deserve the best in return for what they give to our country – and with VA home loans, the best is what they get. VA home loans have extremely competitive interest rates, in many cases they can range between 0.25% to 1% lower than comparable conventional loans. What’s more, VA loans in Florida typically don’t require down payments or private mortgage insurance in the majority of cases, making homeownership even more affordable. If you’re a veteran looking to purchase the perfect home for your family or refinance an existing property, then we’re here to help. Security America Mortgage is proud to serve veterans and help them use VA home loans to secure a home for their families.

What Is a VA Home Loan?

VA home loans are a special type of loan available to veterans. They’re provided by private lenders and guaranteed by the Department of Veterans Affairs (DVA). The DVA guarantees up to 25% of the loan, making VA loans a lower-risk loan for lenders and enabling them to offer more favorable terms as a result. VA home loans are available to veterans, active service members, and in some cases even their spouses. They offer some of the very best terms on the market, including competitive interest rates, no down payments, no mortgage insurance repayments, and flexible qualification standards.

VA Loans in Florida Requirements

The main requirement for a VA home loan is a Certificate of Eligibility from the DVA showing that the applicant has completed the necessary length of service to be eligible for the loan. In terms of credit requirements, VA loans are often more flexible than other loan types, as the DVA’s 25% guarantee makes them a lower-risk option for lenders and therefore enables them to offer loans to more individuals. This means VA home loans can be more accessible to veterans with lower credit scores than other loan types in many cases. As a result, Security America Mortgage is proud to offer flexible VA home loans that veterans can easily apply for. With relaxed credit requirements, a simple application process, and the support of experienced, caring professionals, Security America Mortgage’s VA home loans are a great option for veterans looking to buy their dream home.

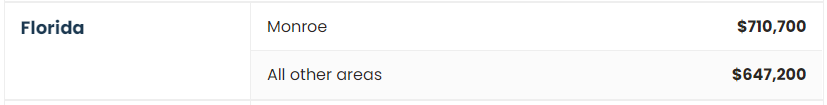

VA Loan Limits

As of 2020, the VA loan limit was removed for veterans with full entitlement – meaning that veterans can borrow any amount and the DVA will guarantee up to 25% of the full loan as long as they hold full entitlement. Full entitlement means you’ve either never used your VA home loan benefit, paid off a previous VA mortgage in full and sold the property, or repaid the full loan after a short sale. However, there are VA loan limits for veterans with remaining entitlement based on county loan limits. For instance, if you’ve taken out a VA home loan that you’re still paying back, the DVA will only guarantee 25% of your county’s loan limit minus any entitlement you’ve already used.

let's know Benefits of VA Loans in Florida

A VA loans in Florida offers a variety of benefits to veterans living in Florida, paying them back for their service by enabling them to pursue the house of their dreams.

0% Down Payment

One of the biggest obstacles to homeownership is being able to save up money for a down payment. Since a VA loan doesn’t require a down payment, this obstacle is removed, allowing qualified veterans to buy the home they deserve more easily.

Extremely Competitive VA Loan Rates

VA home loans offer highly competitive interest rates. In fact, VA home loan interest rates can typically range anywhere between 0.25 and 1% lower than comparable standard loans.

Relaxed Qualification Standards

Since the DVA’s guarantee lowers the risk to the VA approved lender, VA loans allow more relaxed qualification standards. VA home loans generally have lower credit score requirements than conventional loans, and may also allow for a much higher debt-to-income ratio.

No mortgage insurance

Normally, home loans require that borrowers who can’t pay a 20% down payment on a home must pay private mortgage insurance to protect the VA approved lender. However, being that the DVA guarantees 25% of the VA loan, this requirement is negated allowing veterans to avoid costly monthly mortgage insurance payments.

Low Closing Costs

A VA loan allows you to negotiate with the seller to pay up to 4% of the purchase price towards your closing costs. Allow Security America Mortgage to help you obtain a Florida VA loan and you could close with very little to no out of pocket costs.

Variety Of Refinancing Options

Since there are no prepayment penalties on a VA loan, you’re free to refinance to take advantage of lower interest rates. Security America Mortgage can even help you refinance to quickly and easily turn up to 90% of your property’s value into cash in Florida.

Eligibility of VA Loans in Florida

The federal eligibility requirements for the VA loan program rest on the type and length of your service. VA home loans are primarily available to active service members, but National Guard or Reserve members may also be eligible, and spouses may also apply for VA home loans under some circumstances.

Generally, active service members must have completed 90 continuous days of service to be eligible. Veterans must have served at least 181 days in active duty, or less if they were discharged honorably for a service-related disability or similar reason.

National Guard and Reserve members must have served at least 90 days in active service; if not, they must have served at least 6 years and have been discharged honorably (or continue to serve). Finally, spouses of veterans who died in active duty or as a result of a service-related disability may also have VA eligibility if they have not remarried.

Have a look at our most recent blog posts about VA Loans

Our team at Security America Mortgage makes every effort to ensure the home buying process as transparent and stress free as possible.

Our team at Security America Mortgage makes every effort to ensure the home buying process as transparent and stress free as possible.

Are you ready to take advantage of your VA loan benefits? If so, it’s simple to start the process and takes only a few minutes. No social security number needed to start!

Active service members with at least 90 continuous days of service and Veterans who’ve been honorably discharged from the armed forces can apply for a VA loan. Get started today!

FAQs of VA loans in Florida

What is the current VA home loan rate in Florida?

VA home loan rates may differ based on your credit score, loan type, loan duration, and the current state of the market. Treasury bond, Ginnie Mae bond and Fannie Mae bond rates and yields can affect market rates on VA home loans. There are other factors on market rates for VA home loans and Security America Mortgage uses tracking tools to help lock in the best market rates for our clients.

How do VA home loan credit requirements work?

Loan credit requirements for VA home loans are set by the lender, meaning they can differ from mortgage company to mortgage company. Most lenders require a minimum credit score of 640; however, some lenders accept credit scores as low as 600.

What if I’ve used a VA home loan before?

If you’ve already used a VA home loan, paid it off in full, and wish to buy a second property without selling the original one, you can have your previously used VA loan entitlement restored – but only once. However, if you’ve paid off your previous VA loan in full and sold the property you used it to buy, you’re free to restore your entitlement as many times as you want.

Do all lenders offer VA home loans?

Not necessarily – Florida VA loans are a specific niche in the market, and not every mortgage company provides them. Even if a general mortgage company does provide VA loans, you may be better off choosing a Florida VA loans specialist like Security America Mortgage – we have the specific expertise and experience to guide you through the process and make the most of your loan entitlement.

Can you use VA home loans for a second home, income property, or vacation home?

Generally, the law states that a VA home loan must be used for a home you intend to occupy within 60 days of closing. However, in some cases, this occupation requirement may be fulfilled by your spouse or dependent alone (as long as it is intended to be your own primary residence eventually as well).

You cannot use a VA home loan to buy a property that is solely intended as an investment. However, they can be used to purchase properties with up to four units, meaning that as long as one of these units is your primary residence the other three may be used as income properties.

Testimonials

All members of our team here at Security America Mortgage are experts when it comes to helping veterans obtain VA Home Loans. If you’re ready to get started complete the simple form above and one of our mortgage specialists will contact you shortly. We look forward to working with you!

Florida VA Jumbo Loan

A Florida jumbo mortgage is a home loan of which value exceeds conventional home loan limits which are set by Fannie Mae and Freddie Mac. Typically, jumbo mortgages are used to finance the purchase of luxury, high-end properties, homes, or condos. The jumbo mortgage, conforming limit in “high-cost” areas is currently $625,500. Jumbo mortgages also subject lenders to significantly higher risk due to the fact that if a jumbo mortgage loan defaults it would be harder to sell a luxury residence quickly for full price. With this in mind, the interest rate charged on a jumbo mortgage loan is generally higher than a conforming home loan and, depending on which lending you chose, the rate can fluctuate significantly. At Security America Mortgage, all our mortgage specialists are experts in all types of jumbo mortgages and we offer extremely competitive market rates. If you are looking to obtain a Jumbo Loan Florida and want to streamline the entire process then contact us today by completing the form on this page.

If you are in Florida and need a large home loan, apply with us to find your interest rate in order to find out if you qualify. We are licensed in the State of Florida and have specialists who are experts in the state. We offer friendly customer service and have years of experience in the field of mortgage loans. Apply for Jumbo Loan Florida above today!

|

More Calculators

VA Loan Calculator

Determine how much home you can afford.

Funding Fee Calculator

Learn what it costs to fund a VA loan.

BAH Calculator

Calculate your Basic Housing Allowance.

VA Loan Limit Calculator

Find out how much you can borrow for $0 down.

Construction Loan Calculator

Obtain a construction loan for building or improving a home

Affordable Calculator

Estimate your loan preapproval amount based on your income and expenses.

VA Refinance Calculator

See if refinancing makes sense for you.

We are dedicated to

serving Those who served.