VA Loans in Colorado: VA Lenders Helping Veterans Get Their Dream Home

Apply for your Home Loan in Colorado Today!

At Security America Mortgage, we’re proud to serve those who have served our country. We help veterans and their families to access affordable home loans in Colorado, through the VA, to make their dream houses a reality.

Are you ready to start your home loan process? Then simply fill out the quick one-minute form below to get started! We’ll provide a no-obligation consultation to help you estimate how much you may be able to borrow.

"*" indicates required fields

Why Should I Get a VA-Backed Loan in Colorado?

With its outdoor lifestyle, cost of living and beautiful landscapes it is no wonder why many cities in Colorado, like Denver, have been rated some of the best places to live, which make it a great state for you to settle down and purchase your dream home. And by doing so with a VA Loan you also take advantage of no PMI and up to 0% down payment. In addition, the median sale price is $525,000 in Denver, for example. So, with that median sale price you are still below the VA Home Loan limit. VA-Backed Loans require 0% down payment in most cases, whereas conventional loans generally require at least a 3% down payment and sometimes up to 20% required. FHA Loans require a minimum of 3.5% down payment.

Should I Choose a Colorado Jumbo Loan?

Many Veterans have already taken advantage of their VA benefits. With relaxed qualification standards and more flexibility, it is proven to be the right choice for many to purchase and refinance their homes through this program. However, in most counties, the conforming loan limit with no money down is $548,250. When your home costs more than this, the solution is a VA Jumbo Loan. A VA Jumbo Loan is any VA-Backed Loan bigger than $548,250. And qualifying Veterans can apply to purchase or refinance their home for up to a value of $1,000,000 through this type of loan, plus receiving all the benefits of the general Colorado VA Loan.

These are the Key Benefits that Security America can Offer you to get a VA Loans in Colorado

1. VA, FHA, and All Home Loan Types.

2. $0 Down Payment for VA Home Loans.

3. No Need for Private Mortgage Insurance.

4. Competitive interests rates.

5. Lower Payments.

6. Easier to Qualify.

7. Relaxed Credit Standards.

VA Loan Overview

Colorado VA Home Loans are loans made available to military veterans, reservists, and active-duty members for the purchase of a primary residence. The Veterans Administration does not lend money for the mortgage; instead, it guarantees the top 25 percent of the loans made by private lenders, such as Security America Mortgage, to those who are compliant with the VA Loan Eligibility criteria. Qualified veterans can use their loan benefit to purchase a home with zero money down, no private mortgage insurance, and have the sellers pay all of their closing costs. These benefits, along with highly competitive interest rates, are making VA Home Loans in Colorado the preferred loan choice for many veterans.

VA Mortgage Rates and Costs

VA Loans in Colorado have the same costs associated with closing as all other home loan products, but there are two key differences in terms of closing costs with a VA-Backed Loan. First, if negotiated into the purchase contract, all closing costs and prepaid items can be paid by the seller, totaling up to 4 percent of the purchase price. Second, the Department of Veterans Affairs charges a VA Funding Fee on every loan it guarantees. The VA Funding Fee is paid directly to the VA and helps to pay for the Home Loan Program for all current and future homebuyers. This fee ranges from 1.25 percent to 3.3 percent but is waived for veterans with service-connected disabilities. Also, the VA Funding Fee can be paid in full at closing or rolled into the loan at closing. Typically, the interest rates for VA Loans in Colorado are lower when compared to conventional and FHA loans, but you can check out our VA Loan calculator to help you determine your payments!

Have a look at our most recent blog posts about VA Loans

Our team at Security America Mortgage makes every effort to ensure the home buying process as transparent and stress free as possible.

Our team at Security America Mortgage makes every effort to ensure the home buying process as transparent and stress free as possible.

Are you ready to take advantage of your VA loan benefits? If so, it’s simple to start the process and takes only a few minutes. No social security number needed to start!

Active service members with at least 90 continuous days of service and Veterans who’ve been honorably discharged from the armed forces can apply for a VA loan. Get started today!

VA Mortgage Loans Benefits

No mortgage insurance

Since the VA guarantees the lender the top 25 percent of the loan, no mortgage insurance is required. Most conventional loans require a borrower to put down at least 20 percent of the purchase price or pay mortgage insurance. Mortgage insurance can be costly and does not ever go towards reducing your principal balance.

Competitive interests rates

Because the Department of Veteran Affairs guarantees each loan, interest rates are typically 0.25 to 1 percent lower than those of conventional loans.

No down payment

Saving enough money for a down payment can be especially difficult for active duty service members who are moving from base to base. Since there is no down payment required for a VA Home Loan, many veterans can purchase a home with little to no money out of pocket.

Contact Your Colorado VA Mortgage Expert

I have been in the mortgage/financing industry for many years and through all of these years, many things have become obvious to me and my associates. With my background in financing, ability to provide clear instruction, and execute game plans I can support our Military every day.

Contact me and I will get you started on getting your home loan!

Get Your VA Loans in Colorado Today!

If you are ready to start the application process for your house loan, fill the form below and get pre-qualified!

Construction Loans in Colorado

We offer a VA one time close Construction loan in Colorado. Our VA construction loan has many benefits including:

- Saving time and money with one closing as opposed to 2.

- No requalification required.

- No need to pay 2 sets of closing costs.

- Fixed interest rate

Construction Loan Calculator for Colorado

It’s important to estimate your construction loan payments and terms and our construction loan calculator can help you. To best utilize the construction loan calculator you should have an idea of what your land is valued at or what it will cost along with, an approximate amount to build the home you want. Plans will be appraised with the land to determine an appraised value.

FAQs of VA Loans in Colorado

What are the VA Home Loan Requirements in 2022?

Everyone who meets the following could be eligible for a VA-Backed Loan:

- You have served 90 consecutive days of active service during wartime.

- You have served 181 days of active service during peacetime.

- You have 6 years of service in the National Guard of Reserves.

- You are the spouse of a service member who has died in the line of duty or as result of a service-related disability.

Do all Lenders Offer VA Loans?

Not necessarily – Colorado VA Loans are a specific niche in the market, and not every mortgage company provides them. Even if a general mortgage company does provide them, you may be better off choosing a specialist like Security America Mortgage – we have the specific expertise and experience as VA lenders in Colorado to guide you through the process and make the most of your loan entitlement.

How Often Can I Use My VA Loan Benefit?

If you’ve already used a VA Loan, paid it off in full, and wish to buy a second property without selling the original one, you can have your previously used entitlement restored – but only once. Although, if you’ve paid off your previous loan in full and sold the property you used it to buy, you’re free to restore your entitlement as many times as you want.

Can a VA Loan be Used as a Construction Loan in Colorado?

Whether you’re a veteran or active military member looking to build a custom home, a VA Construction Loan could be the perfect solution for you! Because of your military background, you have access to VA Home construction loans that offer nothing down and additional perks and benefits.

Usually, it’s more difficult to get a construction loan than an existing home loan, as lenders are more cautious funding a home that doesn’t exist yet.

However, here at Security America Mortgage we are VA Construction Loan lenders as well as experts, and we will be more than happy to help you get your own custom dream home whether you want to build it in Colorado Springs, Aurora or any other city in Colorado.

What is the Needed Credit Score for a VA Loan?

Loan credit requirements for VA Home Loans are set by the lender, meaning they can differ from mortgage company to mortgage company. Most lenders require a minimum credit score of 640; nonetheless, some lenders accept credit scores as low as 600.

Does VA Loan Pay PMI (Private Mortgage Insurance)?

VA Home Loans do not have private mortgage insurance requirements. Additionally, VA Loans usually have lower rates than conventional loans.

How Long is the Process for Getting a Home Loan?

Many factors go into the timing of the process. To be safe, you should allow at least 30 days for the entire VA Mortgage process to take place. However, it is possible to close in as little as two weeks. With the help of our VA Loan Specialists, the process is quick and easy!

Testimonials

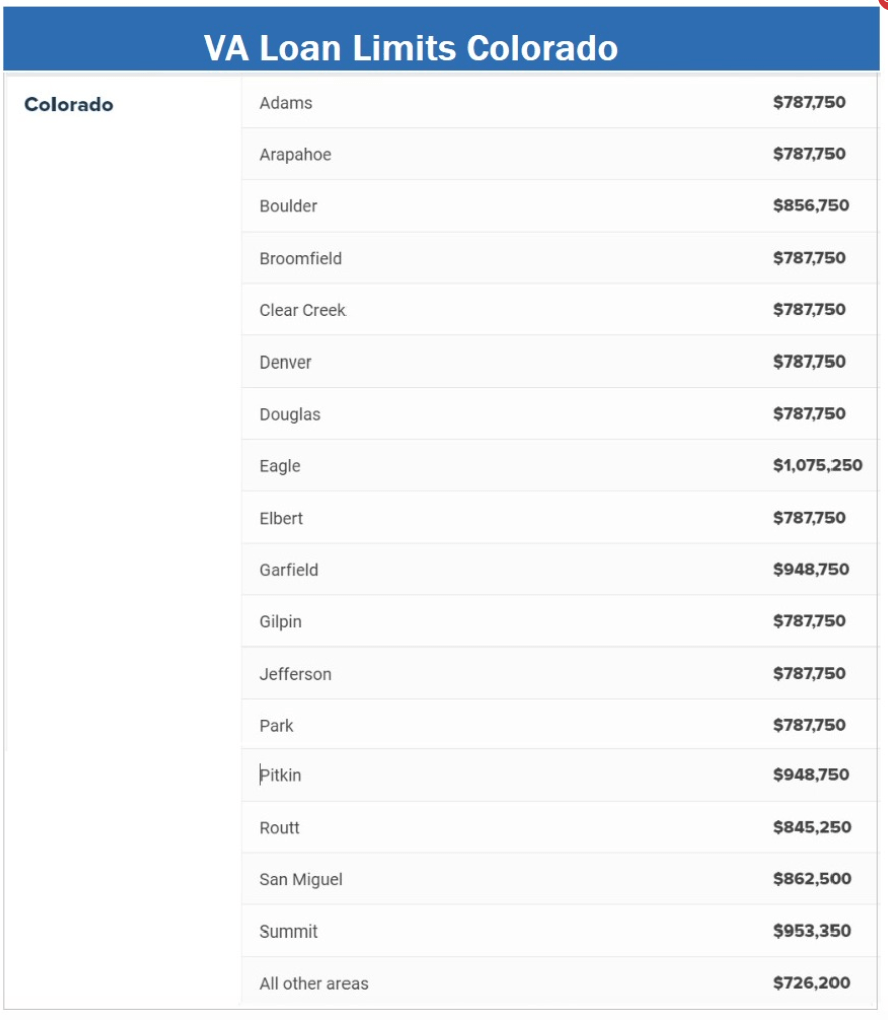

Colorado VA Loan Limits

VA Purchase Loans in Colorado cover more property types than just homes and condominiums, qualified veterans can use their VA Home Loan to purchase a property that has up to four one-family units.

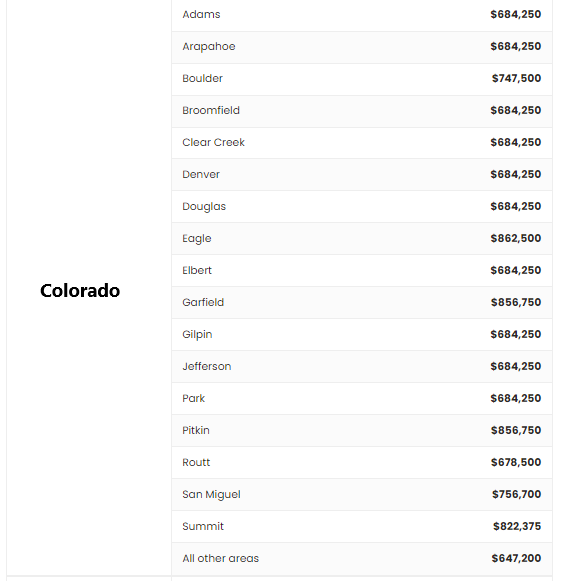

And as for the maximum VA Loan amount in Colorado, it is different from county to county:

|

Colorado VA Loan Limits

Veterans who have never used their VA loan benefit don’t have a va loan limit in Colorado, but subsequent users will need to follow the va loan limits in 2023. See the pic below for 2023 VA loan limits in Colorado Counties.

What Is Construction-To-Permanent Financing?

Construction-to-permanent (C2P) financing is a type of construction loan that we offer. It’s great because it combines both a construction loan and a permanent mortgage into a single transaction. This type of loan is ideal for borrowers who are building a new home because it allows them to finance the entire project with one loan. Construction to permanent financing is another name for OTC/One time close and we offer a variety of one time close construction loan programs including the FHA One time close, VA One time close, USDA one time close and Conventional one time close construction loan.

More Calculators

VA Loan Calculator

Determine how much home you can afford.

Funding Fee Calculator

Learn what it costs to fund a VA loan.

BAH Calculator

Calculate your Basic Housing Allowance.

VA Loan Limit Calculator

Find out how much you can borrow for $0 down.

Construction Loan Calculator

Obtain a construction loan for building or improving a home

Affordable Calculator

Estimate your loan preapproval amount based on your income and expenses.

VA Refinance Calculator

See if refinancing makes sense for you.

We are dedicated to

serving Those who served.